Advertisement

Advertisement

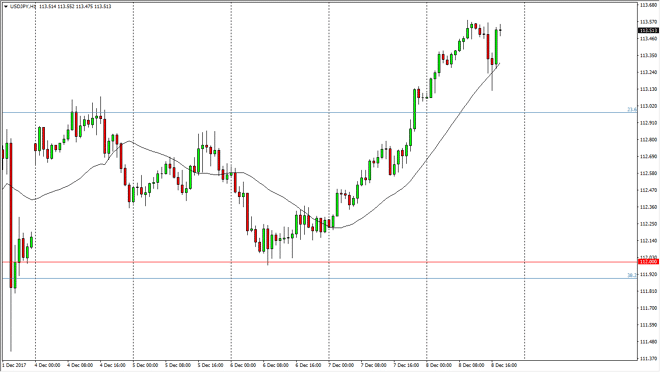

USD/JPY Price Forecast December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:02 GMT+00:00

The US dollar has rally during the trading session on Friday, and now looks to be recognizing the 113 level at short-term support. The jobs number printing 220,000 jobs for the month of November of course helps.

The US dollar continue to go higher during the trading session on Friday, as the job number continues to show signs of life. It looks likely that the 113.50 level is going to offer short-term resistance, but these pullbacks should continue to be buying opportunities, especially if we can find the 113 level supportive. The 114.50 level above is a target, and the resistance should extend to the 115 handle. In general, this is a market that continues to be noisy in general, and therefore I think that the prudent action is to take small positions, but typically this time year we have the so-called “Santa Claus rally”, which lifts stock markets. By extension, that quite often will lift this pair as well.

I think that the interest rate statement coming out the Federal Reserve this month will be vital as well, as the outlook for the US dollar will probably strengthen due to the hawkish sentiment. Overall, I believe that the market is a “buy on the dips” type of situation. The market continues to look likely to be noisy, so adding every time you get a move in your direction is probably the best way to deal with, but doing so in small increments would make quite a bit of sense. If we were to break down below the 113 handle, I think then we go looking towards the 112 level for support, which it has most certainly founded there recently. The Japanese yen of course is the safety currency in this pair, so as long as the markets are reasonably healthy, this market should continue to go higher.

USD/JPY Video 11.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement