Advertisement

Advertisement

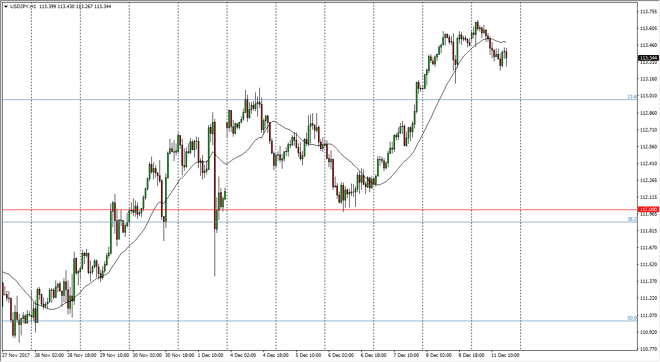

USD/JPY Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:04 GMT+00:00

The US dollar continues to elevate itself against the Japanese yen, but Monday was a little bit softer than the previous sessions. Given enough time though, it’s very likely that we will continue to grind higher.

The US dollar drifted a little bit lower during the trading session on Monday, but continues to find support just below. I think that the 113 level is going to be supportive, so it’s not until we break down below there that I must reassess the situation. Given enough time, I think that we go looking towards the 114.50 level, which is an area that begins extensive resistance to the 115 handle. I believe that the volatility will continue, but the Wednesday announcement coming out of the Federal Reserve will be the biggest driver of this pair this week. I believe that if the Federal Reserve tightens interest rates, and more importantly suggests that we are going to continue to do so going forward, this pair will take off to the upside and it might give the market the wherewithal to break out above the 115 handle.

Short-term pullback should offer buying opportunities, and I believe that the “floor” is the 112-level underneath. Even though I think that the 113 level should hold as support, I think that longer-term, the 112 level is even more important, so if we were to break down below there I think that the market probably drop significantly. I suspect that this will be due to the Federal Reserve sounding dovish if it happens, but right now I do not think they are willing to do that. The volatility of course will continue, but I still believe that the upward momentum will be the main driver of things going forward.

USD/JPY Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement