Advertisement

Advertisement

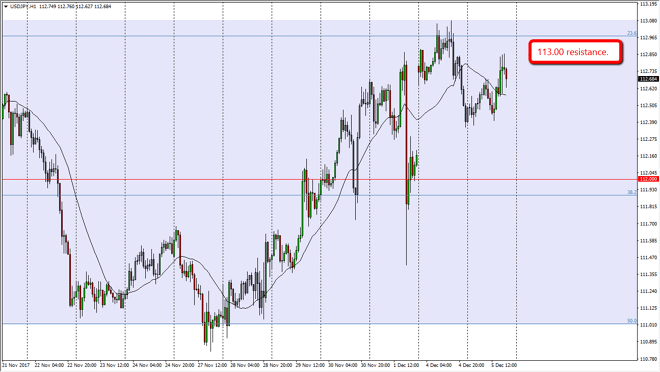

USD/JPY Price Forecast December 6, 2017, Technical Analysis

Updated: Dec 6, 2017, 06:56 GMT+00:00

The US dollar rallied a bit during the day on Tuesday, as we continue to struggle at the 113 handle. A break above that level should be a good sign, and perhaps could send this market much higher.

The US dollar rallied against the Japanese yen was perhaps in reaction to the US Congress looking likely to pass tax reform. That of course will be good for the United States economy, and of course the potential interest rate hikes coming should be good for the US dollars well. The interest rate differential between the 2 economies will continue to favor the upside, and if we can get more of a “risk on” stock market, that could be reason for this market to go higher also. A break above the 113 handle sends this market looking for the 114.50 level above, which is the beginning of resistance extending to the 115 handle. Once we finally clear that level, the market is more of a “buy-and-hold” situation. In the meantime, I like buying dips, if we can stay above the 112 level.

A breakdown below the 112 level probably sends the market looking towards the 111-level underneath, which has been rather supportive and of course is the 50% Fibonacci retracement level from the recent move higher. The volatility is to be expected, as this pair is volatile under the best of circumstances. I don’t have any interest in shorting, least not anytime soon as I think that there is more than enough reason to think that the US dollar should climb, either due to the interest rates, tax bill, or perhaps even quantitative easing coming out of the Bank of Japan. I don’t have any interest in putting a large position on though, so adding slowly as the trade goes in your favor would probably be the best way to go.

USD/JPY Video 06.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement