Advertisement

Advertisement

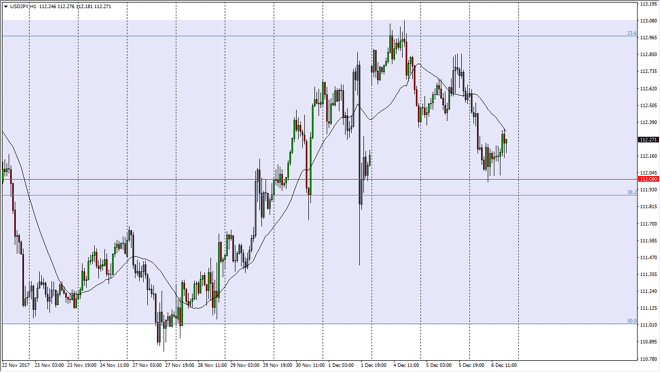

USD/JPY Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:02 GMT+00:00

The US dollar initially fell during the trading session on Wednesday, but found enough support at the 112 level to turn around and start showing signs of life again. Because of this, I think this has been a “buy the dips” opportunity.

The US dollar initially fell against the Japanese yen, reaching down towards the vital 112 handle. This is an area that has been supportive in the past, and it looks like we are bouncing from there again. Because of this, I think that the market is ready to continue to try to build up enough momentum to go to the upside, perhaps testing the 113 handle again. That’s an area that has been rather attractive for traders, and I think eventually we will break above there and go looking towards the 114.50 level next, the beginning of a major resistance barrier that extends to the 115 handle.

Ultimately, I believe that short-term pullbacks are buying opportunities, and that the volatility could continue but in the end, I believe that interest rate hikes coming out of the United States will continue to lift this market. If there’s any type of dovish words coming out of the Bank of Japan, we should see this market continue to go higher. Beyond that, I believe that the market has been trying to bottom for some time, and that of course allows for volatility, and of course a lot of uncertainty. However, if you look back at the longer-term charts, we have seen quite a bit of volatility in these moves, which is quite typical for what would be a volatile market. I think that the 111.80 level underneath should continue to offer support underneath the 112 level, so I think it’s only a matter of time before the buyers return. If we were to break down below the 111.80 level, then I think at that point we go down to the 111 handle.

USD/JPY Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement