Advertisement

Advertisement

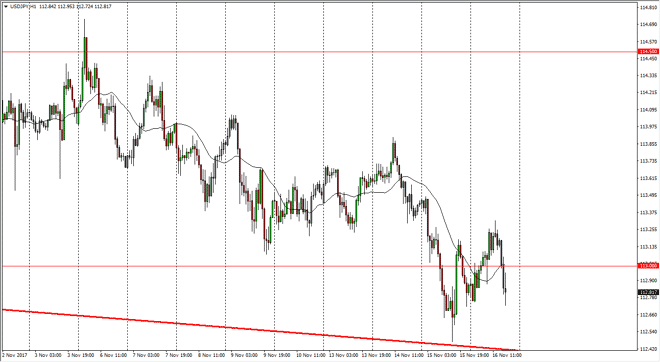

USD/JPY Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 04:59 GMT+00:00

The US dollar has been very choppy against the Japanese yen during the trading session on Thursday, as we continue to dance around the 113 handle. The

The US dollar has been very choppy against the Japanese yen during the trading session on Thursday, as we continue to dance around the 113 handle. The previous downtrend line that was the top of the channel is offering support, but the past 24 hours have not been particularly encouraging. If we were to break above the 113.33 handle, I think the market will continue to pick up the momentum and send this market towards the 114 handle. Overall, it’s likely that we will find buyers, but I think that the markets will continue to be very difficult to deal with. The markets are typically noisy, but they are going to be even more so as the stock markets look a bit exhausted. However, the interest rate differential still favors the US, and probably will going forward.

If we were to break down below the 112 handle, I think at that point the market will probably drop down to the 108 handle below, and that could offer short-term selling opportunity. Longer-term, I do think that the buyers come back but there’s no point in trying to jump into the trade without some type of confirmation. Because of this, I am cautiously optimistic and waiting for some type of opportunity to get bullish. Having said that, if we do break down, I won’t hesitate to short the market for a couple of handles, and then look for the longer-term “buy-and-hold” situation. Market participants continue to weigh whether or not the Federal Reserve will raise interest rates, and I think there are a lot of concerns as the US Congress has not been able to pass tax reform. If they do, this market will take off like a rocket, so keep that in the back of your mind.

USD/JPY Video 17.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement