Advertisement

Advertisement

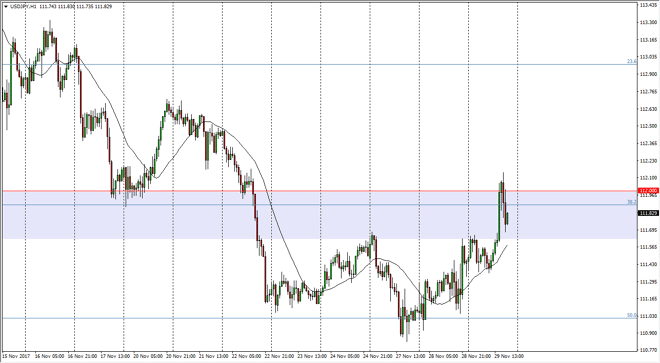

USD/JPY Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:05 GMT+00:00

The US dollar was a very choppy during the trading session initially on Wednesday, but then broke above the 112 level, only to find enough resistance to

The US dollar was a very choppy during the trading session initially on Wednesday, but then broke above the 112 level, only to find enough resistance to turn things back around. At this point, if we can clear the highs of the day, I believe that it will show that momentum has picked up enough to continue to drive this pair to the upside, perhaps the 114.50 level again. I think that a lot of this is going to come down to what happens in Congress, and whether we can get some type of tax bill passed. We have cleared a couple of girls so far, so it could be a good sign that we are in fact going to get them. By making a “higher high”, it’s likely that the momentum to the upside will continue to strengthen, and at this point I still favor the upside, although this market has been noisy to say the least.

I also believe that there is a massive amount of resistance between the 1.1450 level and the 1.15 handle, so it’s going to take something special to break through there. Once we do, this becomes a “buy-and-hold” market, and more of an investment and less of a trade. In the meantime, expect the choppiness to continue, but this could be an opportunity to build up a large position over the longer term, and simply ride the US dollar higher as interest rates climb. It looks as if the central banks around the world are trying to do whatever they can to move the currency markets, and with the Federal Reserve being by far the most hawkish central bank out there, it makes sense that we would see this market rally, barring some type of massive geopolitical issue.

USD/JPY Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement