Advertisement

Advertisement

USD/JPY Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:10 GMT+00:00

The US dollar initially tried to rally during the week, but found trouble above the 114.50 level, the beginning of significant resistance that extends to

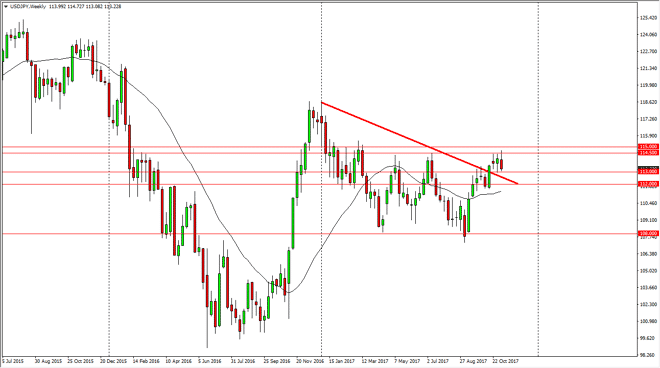

The US dollar initially tried to rally during the week, but found trouble above the 114.50 level, the beginning of significant resistance that extends to the 115 handle above. By forming the negative candle that we did, I think we could drift a bit lower, perhaps trying to find the previous downtrend line that we have broken above. This would coincide with roughly 112.50, so I’m looking at shorter time frames to find an entry point to the upside. Longer-term, if we can break above the 115 handle, the market should continue to go much higher, with the initial target being the 118.50 level.

However, the meantime there is a lot of uncertainty around the world, not the least of which is the problems with the US Congress passing some type of tax break, which is a major driver of the US dollar in the medium-term. We also have an interest rate differentials between the United States and Japan pushing higher, but this pullback is probably necessary to keep the market full of momentum. If we were to break down below the 112 level, that would be a very negative sign and could send this market much lower. Ultimately, at that were to happen we could go as low as 108. However, I still believe that the buyers are going to eventually when the argument. For the longer-term trader, they may be better off waiting for a supportive candle to get involved. I suspect that we may get when this coming week, but it may not actually form itself until late, meaning that you should be able to get confirmation by the Friday trading session. If not, then I suspect it’ll, 2 weeks down the road. Either way, I expect the buyers to return.

USD/JPY Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement