Advertisement

Advertisement

A Quiet Economic Calendar Leaves the Dollar on the Back Foot Early

By:

It's a quiet day ahead on the economic calendar. A lack of stats leaves the markets to grapple with geopolitical risk and fiscal and monetary policy.

Earlier in the Day:

It was a relatively quiet day on the economic calendar this morning. The Japanese Yen was in action in the early part of the day.

The markets also responded to better than expected nonfarm payrolls and the unemployment rate from the U.S from Friday.

From the weekend, May trade data out of China provided little comfort, however. While exports fell by 3.3% versus a forecasted slide of 7%, imports tumbled by 16.7%. Economists had forecast a 9.7% decline.

As a result of the slump in imports, China’s USD trade surplus widened from $45.33bn to $62.93bn in May.

In spite of the disappointing numbers, there were enough positives to support riskier assets at the start of the week.

On the positive were the latest COVID-19 numbers, talks of more fiscal stimulus, and fresh expectations of a speedier economic recovery.

From the latest COVID-19 numbers, there was no major spike in new cases across the U.S to cause concern. That should support the continued easing of lockdown measures and the opening of borders.

Looking at the latest coronavirus numbers,

On Sunday, the number of new coronavirus cases rose by 123,802 to 7,085,740. On Saturday, the number of new cases had risen by 138,258. The daily increase was lower than Saturday’s rise, while higher than 112,909 new cases from the previous Sunday.

Germany, Italy, and Spain reported 610 new cases on Sunday, which was down from 884 new cases on Saturday. On the previous Sunday, 734 new cases had been reported.

From the U.S, the total number of cases rose by 20,274 to 2,007,449 on Sunday. On Saturday, the total number of cases had risen by 34,499. On Sunday 31st May, a total of 20,569 new cases had been reported.

For the Japanese Yen

Finalized 1st quarter GDP numbers provided the Japanese Yen and the markets with little direction early in the day.

Quarter-on-quarter, the economy contracted by 0.6% in the 1st quarter, following a prelim 0.9%. In the 4th quarter, the economy had contracted by 1.9%.

Year-on-year, the economy contracted by 2.2% in the 1st quarter, following a prelim 3.4% contraction and 7.3% contraction in the 4th quarter. Economists had forecast a 2.1% contraction.

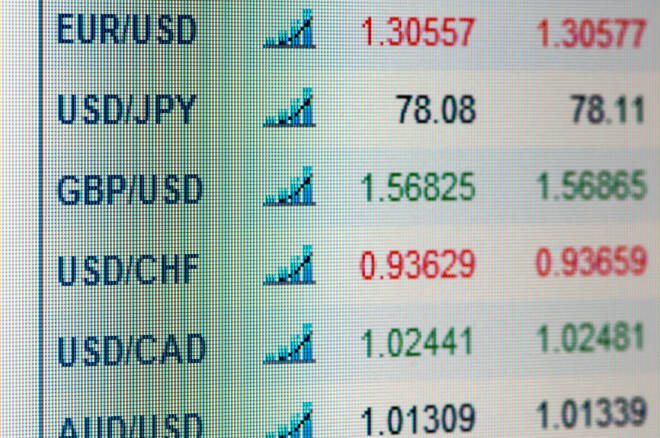

The Japanese Yen moved from ¥109.613 to ¥109.569 upon release of the figures. At the time of writing, the Japanese Yen was up by 0.11% to ¥109.47 against the U.S Dollar.

Elsewhere

At the time of writing, the Aussie Dollar was up by 0.10% at $0.6976, with the Kiwi Dollar up by 0.23% to $0.6522.

The Day Ahead:

For the EUR

It’s a relatively quiet day ahead on the economic calendar. German industrial production figures for April are due out.

We aren’t expecting any influence from the numbers. We’ve seen May manufacturing PMI numbers and the German coalition government has delivered a bazooka stimulus package to give the economy a kick start.

Away from the economic calendar, expect market risk sentiment to influence on the day. China’s weak import figure for May is a red flag for manufacturers near-term.

At the time of writing, the EUR was up by 0.02% to $1.1294.

For the Pound

It’s a particularly quiet day ahead on the economic calendar. There are no material stats due out to provide the Pound with direction.

The lack of stats will leave the Pound in the hands of Brexit and market risk sentiment. There was nothing positive, though nothing new on the Brexit front to test support for the Pound.

At the time of writing, the Pound was up by 0.27% to $1.2702.

Across the Pond

It’s also a particularly quiet day ahead on the U.S economic calendar. There are no material stats due out of the U.S later today.

Lack of stats will leave the markets to ponder on what’s to come from the FED on Wednesday. Any chatter from Washington and Beijing will also need monitoring. Will the latest trade data from China rile the U.S President?

The Dollar Spot Index was down by 0.05% to 96.886 at the time of writing.

For the Loonie

It’s a relatively quiet day ahead on the economic calendar. April building permits and May housing starts are due out later today.

We’re not expecting any response from the Loonie, however. A quiet start to the week will leave the Loonie in the hands of market risk sentiment and the optimism towards the economic outlook.

While China’s trade data from Sunday raised a number of red flags, fiscal and monetary policy support should ease the pain.

At the time of writing, the Loonie was down by 0.04% to C$1.3427 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement