Advertisement

Advertisement

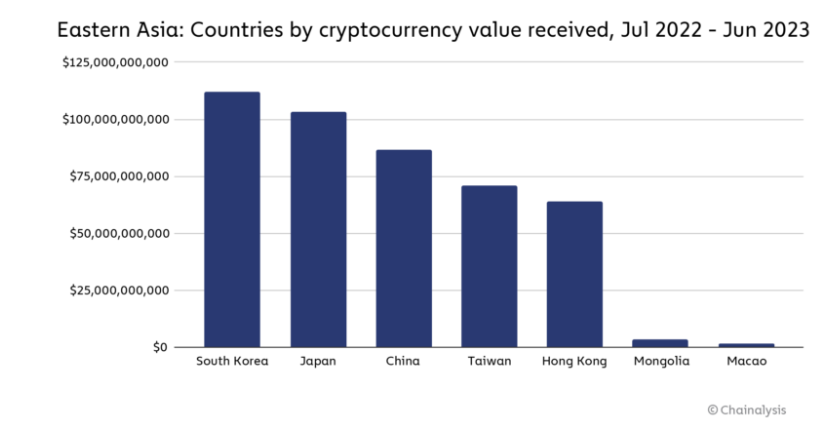

China’s Crypto Trading Surges to $86.4 Billion Despite Bitcoin Ban

By:

An Industry report shows how the Stock market crash and Evergrande housing crisis triggered increased cryptocurrency and Bitcoin trading within China.

Key Insights:

- In 2023, $86.4 billion worth of crypto transactions occurred within China despite its Bitcoin ban.

- The surge in BTC popularity in China is attributed to the downturn in the Chinese stock markets and the Evergrande crisis that rocked the country last year.

- Chinese citizens are reportedly using their $50,000 annual forex purchase quotas to move money into Hong Kong cryptocurrency accounts.

In 2021, China issued a blanket ban on Bitcoin and cryptocurrency investing, trading, and mining within its jurisdiction, citing market manipulation and lax regulatory measures. However, the Bitcoin ban isn’t preventing Chinese citizens from funneling funds into crypto.

Chinese Citizens Flock Towards Bitcoin after Evergrande Real-Estate Crash and Stock Market Downturn

Crypto trading and mining activites have been banned in China since 2021 but as the country experiences a downturn in its stock market in 2023, Chinese residents have been rotating funds into digital assets.

The Evergrande real-estate crash saw investor lose over $81 billion in investment and downpayment on housing units. Meanwhile, China’s CSI 300 stock market index also fell 11.8% in 2023.

Almost everyday, we see mainland investors coming into this market. China’s economic downturn has made investment on the mainland risky, uncertain and disappointing, so people are looking to allocate assets offshore. – a senior executive of a Hong Kong-based cryptocurrency exchange.

China Citizens are Finding Ways around the Ban

According to Reuters, Chinese citizens are using bank cards issued by small-scale commercial banks to buy crypto through grey-market dealers, believing that crypto is “safer than investing in crumbling stock and wobbling property markets”

Currently, Chinese investors use OTC arrangement, online crypto exchanges and overseas bank accounts to buy crypto.

Also, large crypto exchanges like OKX and Binance also offer trading services for Chinese investors by providing guides for converting yuan from Alipay and WeChat Pay into stablecoins.

Exchanges Located in Neighboring Hong Kong to the Rescue

Hong Kong’s a small island nation located close to mainland China has emerged on of the main actors in Chinese citizen’s quest to find ways around the country’s crypto ban.

Due to its warmer embrace of digital assets, and proximity to mainland China, many crypto exchanges and investment firms have obtained Hong Kong licenses. The likes os HashKey Group and OSL both hold retail crypto licenses from Hong Kong’s Securities and Futures Commission (SFC).

It is hard to find opportunities in traditional fields. Chinese stocks and other assets perform poorly … the economy is undergoing a crucial transition.” – Charlie Wong, a 35-year-old buy-side equity analyst who bought Bitcoin via Hashkey.

China’s Crypto Trading Volume Surges to $86.4 Billion Despite Ban

Reportedly, Chinese citizens are using their $50,000 annual forex purchase quotas to channel funds into Hong Kong cryptocurrency accounts.

According to recent report published by Chainalysis, China recorded $86.4 billion in crypto volume between July 2022 and June 2023, which was even significantly higher than Hong Kong’s $64 billion.

These recent developments and rise in trading volumes have led to speculation that “Chinese government may be warming to cryptocurrency and that Hong Kong may be a testing ground for these efforts,” Chainalysis states.

The US SECs recent approval of the Bitcoin Spot ETF is also likely to lead countries like China to soften their stance from a crypto ban to develop a regulatory framework.

About the Author

Ibrahim Ajibadeauthor

Ibrahim Ajibade Ademolawa is a seasoned research analyst with a background in Commercial Banking and Web3 startups, specializing in DeFi and TradFi analysis. He holds a B.A. in Economics and is pursuing an MSc in Blockchain.

Advertisement