Advertisement

Advertisement

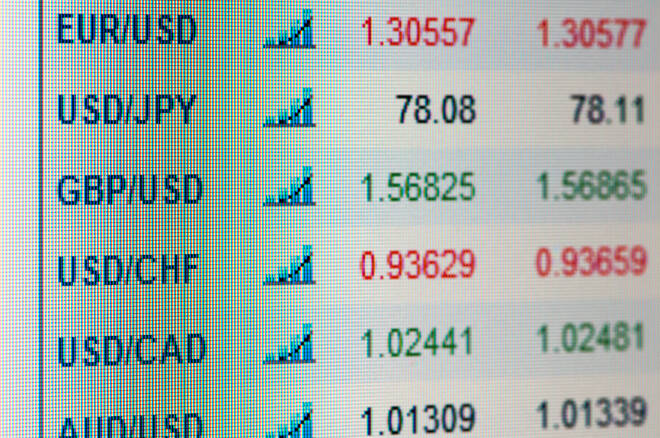

Economic Data Puts the Loonie, the Pound, and the EUR in Focus

By:

A busier economic calendar, COVID-19 news, Brexit updates, and chatter from Capitol Hill will keep the markets busy today.

Earlier in the Day:

It’s was a busy start to the day on the economic calendar this morning. The Japanese Yen and the Aussie Dollar were in action in the early part of the day. Later this morning, the PBoC will also be in action, with loan prime rates in focus. No moves are anticipated, however.

Away from the economic calendar, market jitters over the continued rise in COVID-19 cases weighed on riskier assets early on.

For the Japanese Yen

In October, deflationary pressures picked up, with core consumer prices falling by 0.7% year-on-year. In September, core consumer prices had fallen by 0.3%. Economists had forecast a 0.7% decline.

Consumer prices fell by 0.4%, year-on-year, after having stalled in September. Economists had forecast a 0.3% decline.

The Japanese Yen moved from ¥103.836 to ¥103.794 upon release of the figures. At the time of writing, the Japanese Yen down by 0.10% to ¥103.84 against the U.S Dollar

For the Aussie Dollar

Reversing a 1.10% fall in September, retail sales jumped by 1.6% in October, based on prelim figures. Economists had forecast a more modest 0.3% rise.

According to the ABS,

- Victoria saw sales increased by 5.2%, while still down by 5.7% from October 2019 levels.

- By industry, cafes, restaurants, and takeaway food services led the way.

- Support also came from rising clothing, footwear, and personal accessory retailing, other retailing, and department stores.

- Compared with October 2019, turnover rose by 7.3%.

The Aussie Dollar moved from $0.72781 to $0.72803 upon release of the figures. At the time of writing, the Aussie Dollar was down by 0.11% to $0.7280.

Elsewhere

At the time of writing, the Kiwi Dollar was down by 0.03% to $0.6913.

The Day Ahead:

For the EUR

It’s a relatively quiet day ahead on the economic calendar. German wholesale inflation and Eurozone consumer confidence figures are due out later today.

Expect the consumer confidence figures for the Eurozone to have the greatest impact. With the EU struggling to contain the COVID-19 pandemic, a slide in confidence would add further downside risks to the economic outlook.

Away from the economic calendar, Brexit, COVID-19, and chatter from Capitol Hill will also provide direction on the day.

At the time of writing, the EUR was flat at $1.1875.

For the Pound

It’s a busier day ahead on the economic calendar. October retail sales figures are due out later this morning.

Positive numbers may well have a muted impact on the Pound, however. The British government had to reintroduce lockdown measures at the start of November, which paints a gloomy picture for the quarter.

Away from the economic calendar, Brexit will continue to be a key area of focus.

At the time of writing, the Pound was down by 0.05% to $1.3255.

Across the Pond

It’s a quiet day ahead for the U.S Dollar. There are no material stats to provide the Dollar with direction on the day.

The lack of stats will leave COVID-19 news and any stimulus package news in focus.

At the time of writing, the Dollar Spot Index was down by 0.02% to 92.294.

For the Loonie

It’s a relatively busy day on the economic data front. October house price and September retail sales figures are due out.

Expect the retail sales figures to have the greatest impact on the economic data front.

Away from the economic calendar, however, a continued spike in new COVID-19 cases will test support for riskier assets on the day.

At the time of writing, the Loonie was down by 0.04% to C$1.3078 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement