Advertisement

Advertisement

Germany Moving Its Gold Back Home, Should You Be Worried?

By:

Gold traders remain bullish but speculators that ran to gold after the FOMC decision seem to have backed out of the metal. Gold entered the holiday

Gold traders remain bullish but speculators that ran to gold after the FOMC decision seem to have backed out of the metal. Gold entered the holiday shortened week at 1256.00, silver remains very strong at 15.81 and platinum is down over $15.00 at 973.65. This week has very little events of major risk on the calendar. Regardless of the dovishness of the Fed at last week’s meeting they cannot ignore climbing inflation rates for long and rate increases will be on the agenda in a flash. The dollar rose 0.3 per cent against a basket of major currencies but was still near a 17-month low against the yen and set to end the week 1.2 per cent lower against the currency basket.

The US central bank held interest rates steady on Wednesday and indicated it would tighten policy this year, but fresh projections offered by the Fed showed policymakers expect two quarter-point increases by year-end, half the number forecast in December.

Expectations the Fed would raise rates steadily this year had faded since the bank’s initial hike in December, as concerns about global growth roiled financial markets. A low interest rate environment tends to decrease the opportunity cost of holding non-yielding bullion.

Since the beginning of the year, gold prices have seen a solid move to the upside. Prices continue to trade above their long-term and short-term downtrends. This is encouraging, to say the least.

All that is certain is that gold bullion has surprised investors and just a few months into the year, it has exceeded expectations. Going forward, the precious metal could continue to do so. Investors oversold the precious metal for all the wrong reasons and they are starting to realize this now.

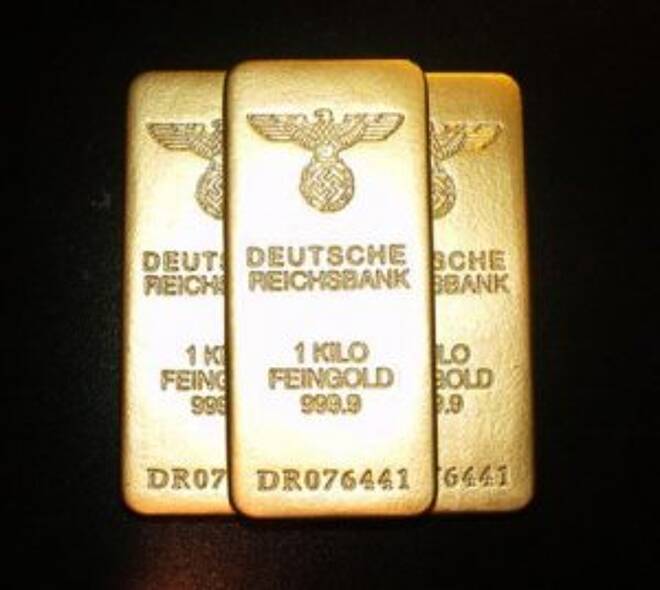

The German central bank accelerated the withdrawal of Germany’s gold reserves from overseas repositories, president of the Bundesbank Jens Weidmann said Sunday.

According to Weidmann, the bank is working on a new concept of the gold storage adopted by Germany in 2013, according to which at least half of the total gold reserves of the country should be transferred to Frankfurt until 2020.

Weidmann said that 366 tons of gold at a total value of approximately 11.5 billion euros have been delivered to Frankfurt so far. According to him, the rest of the gold will be stored in New York and London.

Gold is an additional reserve currency for Germany. According to the Bundesbank, the German gold reserve amounts to approximately 3,400 tons and is the second largest in the world after that of the United States. A well-known analyst said recently that “There are suggestions Germany wants its gold because it’s worried its loans to less fiscally responsible sovereigns won’t be repaid. But many others believe Germany is preparing in case the euro were to eventually dissolve, so it wants its gold to potentially back a new Deutsche Mark. Perhaps they, too, recognize gold’s return to its role as money.”

The gold reserve is to a certain extent a financial regulator for Europe as a whole and ensures Germany a leading role among European countries.

Central banks of foreign countries resumed the withdrawal of their gold reserves from the US Federal Reserve, according to the last report by the last Fed reserve.

A massive repatriation of gold began back in the beginning of 2014.

During the period, a total of 250 tons of physical gold have been withdrawn from the Federal Reserve. The gold reserves in the depository dropped to 5,950 tons, a record low for the last 20 years. Last time, a similar situation occurred ahead of the 2008 financial crisis, and foreign central banks withdrew nearly 400 tons of gold. Taking into account that the current withdrawal has lasted since 2014 and this year has been seeing a new crisis, history is repeating itself.

About the Author

Barry Normanauthor

Advertisement