Advertisement

Advertisement

Marketmind: China focus turns back to the macro

By:

By Jamie McGeever (Reuters) - A look at the day ahead in Asian markets from Jamie McGeever.

By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets from Jamie McGeever.

Asian market trading volumes should return to more normal levels on Tuesday as investors around the world return from the Easter break, with Chinese inflation and an interest rate decision in South Korea the key events in a pretty packed regional calendar.

Australian consumer confidence will also be released on Tuesday, along with unemployment and trade data from the Philippines, and trade and inflation reports from Taiwan.

There was nothing from U.S. or global equities on Monday for traders in Asia to hang their hats on, although U.S. bond yields and implied rates continue to inch higher on the view that the Fed will raise rates by a quarter point on May 3.

There was more movement in currency markets, where the dollar rose across the board and the yen sank. The Japanese currency slumped 1% to a four-week low against the dollar following the first public remarks from new Bank of Japan (BOJ) governor Kazuo Ueda.

Ueda said it was appropriate to maintain the bank’s ultra-loose monetary policy for now as inflation has yet to hit 2% as a trend, suggesting he will be in no rush to dial back its massive stimulus.

At the same time, the BOJ must also avoid being too late in normalizing monetary policy, a sign he will be more open to tweaking its controversial ‘yield curve control’ policy than his dovish predecessor Haruhiko Kuroda.

He has his work cut out.

Chinese stock markets, meanwhile, get a chance to recover from Monday’s 0.5% fall – the steepest in three weeks – now that Beijing has completed its military drills around Taiwan.

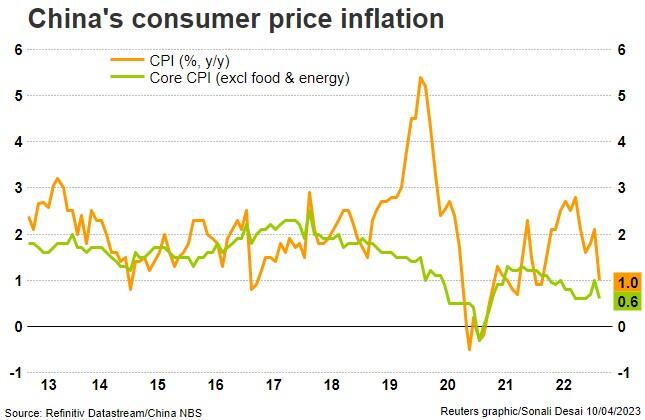

Investors can turn their attention back to the economic data, specifically inflation on Tuesday. Producer price inflation is expected to have fallen further in March, according to analysts’ estimates of a year-on-year decline of 2.5%, which would be the fastest pace of deflation since June 2020.

The annual rate of consumer price inflation is expected to remain unchanged at 1.0%, the slowest in a year, and the monthly rate is expected to rise to 0% from -0.5% in February.

If these forecasts are broadly accurate, price pressures in China would appear to be extremely benign, giving the central bank room to loosen policy and stimulate the economy.

In South Korea, the central bank looks to have ended its tightening cycle and will likely keep its main interest rate on hold at a 15-year high of 3.50% on Tuesday. With the economy on the brink of recession, it could well cut rates later this year.

Here are three key developments that could provide more direction to markets on Tuesday:

– IMF/World Bank spring meetings in Washington

– China PPI and CPI (March)

– South Korea interest rate decision (seen on hold)

(By Jamie McGeever; Editing by Josie Kao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement