Education - Advanced

- David Becker

Asset diversification plays a key role in any investor’s portfolio. Many investors may be thinking why asset diversification is important and properly maintained. The ultimate goal of asset diversification is to strengthen your portfolio and consistently boost performance. When diversifying your portfolio there is no guarantee against loses, however, once

- David Becker

Asset allocation takes place when an investor or portfolio manager allocates capital to multiple kinds of investment vehicles along with strategies used to create hefty returns. Typically, investment managers utilize asset allocation to create a portfolio which will generate the returns which they are looking to achieve. There is a

- David Becker

Within the financial industries risk comes in many forms. When you are looking at industry risk analysis, you are determining the financial risk of investing in an industry and how risk in one specific industry can potentially affect another industry due to spillover. When performing industry risk one should analyze

- David Becker

Hedge Funds stared to flourish back in the nineteen eighties while investors hunted for new opportunities outside the securities and bond markets. The creation of the hedge fund industry can be attributed to sophisticated investors looking for new opportunities to park their money and steer clear of the securities markets.

- David Becker

So you are interested in learning more about short selling and the benefits it can provide you. Short selling in a nutshell is the borrowing of a stock, selling a stock short, and repurchasing the same stock once the market drops to a lower level so that the trader can

- David Becker

Capital markets in the past have been subjected to market risk along with fluctuations of numerous different financial instruments.

- David Becker

Risk management is regarded as a defensive strategy which is utilized to minimize lose along with the potential risks of absolute ruin. When we look at risk as a concept we also correlate risk to reward. In theory, when an investor expands the amount of capital he/she is prepared to

- David Becker

Every week the Energy Information Administration releases its estimate of petroleum inventories.

- David Becker

When an investor speculates in the currency market or a corporate treasurer hedges currency exposure they are purchasing or selling a currency pair which is the exchange of one currency for another.

- David Becker

Human emotion plays a significant role in investing and trading in the Forex markets.

- David Becker

Bottom-up investing is an investment style in which an investor focusses on the fundamental of an individual company. This approach focuses on the analysis of individual stocks. Investors who employ a bottom up style focus on a specific company rather than an industry or macro environment.

- David Becker

Value at Risk Risk management is a framework for describing the depth of risk exposure within a portfolio of assets. Defining the risk management is generally a customized process, and using tools that describe the volatility of the returns is essential toward understand the capital at risk in a desired

- David Becker

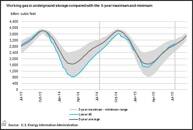

Every Thursday the Department of Energy releases its estimate of inventories for natural gas storage supply in the United States.

- David Becker

There are plenty of times that you may own a currency pair, commodity or equity index that you want to hold, but you are leery about the current market environment. One way to protect yourself against short term adverse move is to purchase or sell options to protect your portfolio.

- David Becker

The interest rate market is a global market which affects consumers, borrowers and lenders worldwide.

- David Becker

Backing testing historical prices is a way of creating a trading strategy as historical patterns can assist in the process of finding changes in sentiment that generate trading signal. By using specific criteria a trader can define and develop a strategy that allows that to profitably transact in the capital

- David Becker

The hedge fund environment sprung to life in the late 1980’s as investors looked for opportunities outside the equity and bond markets.

- David Becker

The capital markets is one of the purest forms of true commerce. Nearly every participant, with the exception of central banks, is involve with one specific intention and that is to make money.

- FX Empire Editorial Board

The MACD (moving average convergence divergence) is a momentum indicator initially developed by Gerrald Appel. The indicator measures momentum by evaluating the difference between a slow moving average and a fast moving average and comparing that difference, called the spread to a moving average of the spread. Since the MACD

- David Becker

The standard definition of a drawdown is the decline in the value of a portfolio from peak to trough, which is measured in percentage terms. By using this definition a drawdown can only be calculated once a portfolio begins to recover after the trough is in place. Some investment managers