Advertisement

Advertisement

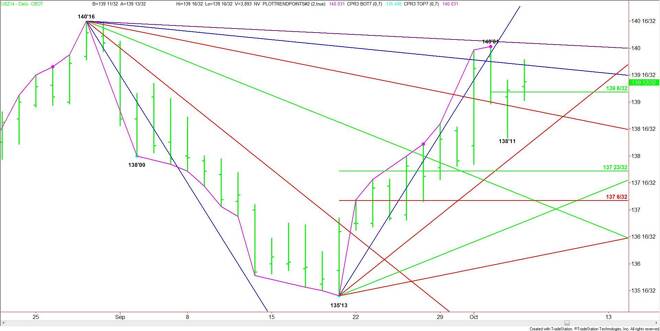

30-Yr U.S. Treasury Bonds (US) Futures Technical Analysis – October 7, 2014 Forecast

By:

December 30-Year U.S. Treasury Bonds rallied on Monday, but the market found resistance at a downtrending angle from the 140’16 top. This angle comes in

December 30-Year U.S. Treasury Bonds rallied on Monday, but the market found resistance at a downtrending angle from the 140’16 top. This angle comes in at 139’21 today. Overtaking this level should lead to a test of last week’s high at 140’01. This is followed by the next downtrending angle at 140’02.5. This is the last potential resistance angle before the main top at 140’16.

The short-term range is 140’01 to 138’11. The pivot price formed by this range at 139’06. This price provided support on Monday and is controlling the short-term direction of the market.

The first sign of weakness today will be the inability to breakout over 139’21, but a break under 139’06 will mean real selling pressure is taking place.

Crossing to the weak side of a downtrending angle at 138’26 could trigger an acceleration to the downside with the uptrending angle at 138’13 the first major downside target.

Look for a possible two-sided trade on light volume as most investors take to the sidelines ahead of Wednesday’s release of the latest Fed minutes.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement