Advertisement

Advertisement

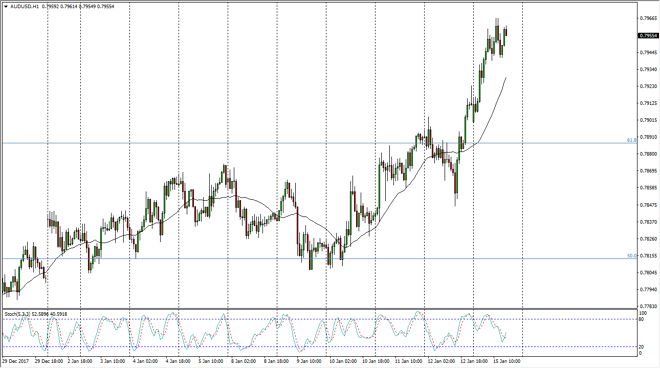

AUD/USD Price Forecast January 16, 2018, Technical Analysis

Updated: Jan 16, 2018, 05:37 GMT+00:00

The Australian dollar rallied significantly against the US dollar during the trading session on Monday, but quite frankly - almost everything did. Because of this, the market is going to go looking towards a major area above, where the longer-term direction of this pair will be determined.

The Australian dollar has rallied significantly during the Monday trading session, reaching towards the 0.7950 level as I record this. However, the 0.80 level above is a significant barrier to overcome, and that area as one that has continued to be important over the longer-term charts. The 0.80 level goes back decades, so I believe it will take something special to break above there, but if we can clear the 0.81 level, I think the Australian dollar can continue to go much higher, perhaps even as high as the 0.85 over the next several weeks. I will be rather volatile and noisy, so it’s likely that will take a certain amount of momentum building to do this.

Look to the gold markets for directionality, because they are the pure “anti-US dollar play” for traders, and have a knock-on effect when it comes to the Australian dollar. I believe that if the gold markets can continue to show strength, the Aussie will eventually make a major breakout that a lot of people were waiting on. At that point, becomes more of a “buy-and-hold” scenario, but until then we will probably see a lot of noise going forward. I believe that ultimately, the one thing that you should count on his volatility, but I certainly believe that we are looking at a definite upward bias, so I’m not looking to sell at all. In fact, I don’t have a scenario in which a willing to short the Aussie right now.

AUD/USD Video 16.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement