Advertisement

Advertisement

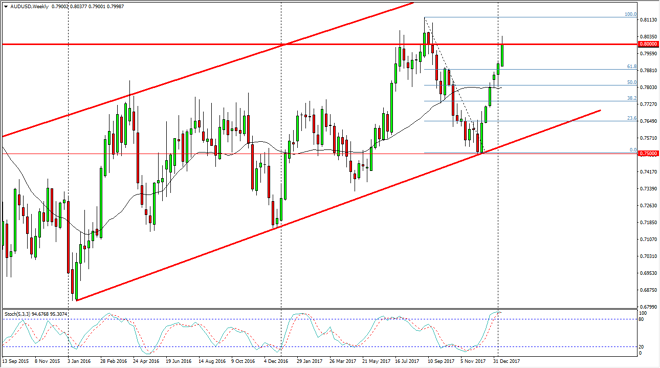

AUD/USD Price forecast for the week of January 22, 2018, Technical Analysis

Updated: Jan 20, 2018, 07:14 GMT+00:00

The Australian dollar has rallied significantly during the week, slamming into the vital 0.80 level. However, this is an area that is massively important, and therefore it takes a massive amount of effort to break above there. I think that the Aussie may need to build up momentum.

The Australian dollar rallied significantly during the week, slamming into the 0.80 level again. This is an area that goes back decades on the charts as both support and resistance. I think that the area will of course be a fulcrum for price, and when we eventually get a decision made at this level, it will lead Australian dollar trading for the next several months, if not years. It is because of this that I have been paying attention to this chart for some time.

Currently, if we break above the 0.81 level I’m willing to put money to work longer term. I think that the market breaking above there should send this market to the 0.85 level next, and then much higher. That’s not to say that we will go there in a straight line, but certainly those would be where I would be looking at. When I look at this chart now, we have shot straight up in the air, and I think that a pullback is not only necessary, but desirable. I would look at those pullbacks as potential buying opportunities, not necessarily a market that I want to start selling.

The up trending channel is very much intact, and I believe that eventually it will lift this market higher. However, we need to see gold breakout for the Australian dollar to go much higher, and it is currently struggling as well. However, I do think that if you are patient enough you should be able to buy this market at lower levels.

AUD/USD Video 22.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement