Advertisement

Advertisement

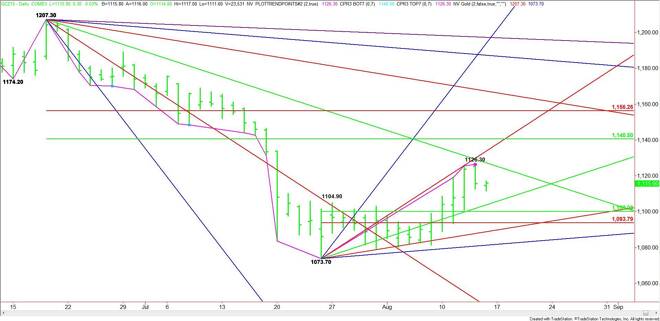

Comex Gold Futures (GC) Technical Analysis – August 14, 2015 Forecast

By:

December Comex Gold futures posted a potentially bearish closing price reversal top on Thursday after the markets settled down following China’s third

December Comex Gold futures posted a potentially bearish closing price reversal top on Thursday after the markets settled down following China’s third intervention this week. The reaction to this last devaluation of the Yuan suggests the financial markets may be stabilizing, diminishing gold’s role as a hedge against market turmoil.

The closing price reversal top was confirmed during the pre-market session when the market crossed yesterday’s low at $1112.80. If the selling persists today then the first target is an uptrending angle at $1103.70. Based on the $1073.70 to $1126.30 range, the primary objective of the chart pattern is the retracement zone at $1100.00 to $1093.80. This area is followed by an uptrending angle at $1088.70.

Yesterday’s high at $1126.30 and today’s early session low at $1111.60 have created a pivot at $1119.00. This price may get tested today if there is a short-covering rally. Trader reaction to this price will then determine the direction of market the rest of the session.

If the buying is strong enough to produce a strong rally tonight then look for a surge into the reversal top at $1126.30 and a downtrending angle at $1127.30. Overtaking this area could fuel a rally into the primary objective of this rally at $1140.50 to $1156.30.

The early session weakness confirmed the closing price reversal top at $1126.30, however, there may be one more rally into $1119.00 before the selling resumes. So either sellers are going to wait for a test of $1119.00 or sell weakness right from the start. Read the order flow to determine the size of the selling. Either way, the primary objective today is the $1100.00 to $1193.80 retracement zone.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement