Advertisement

Advertisement

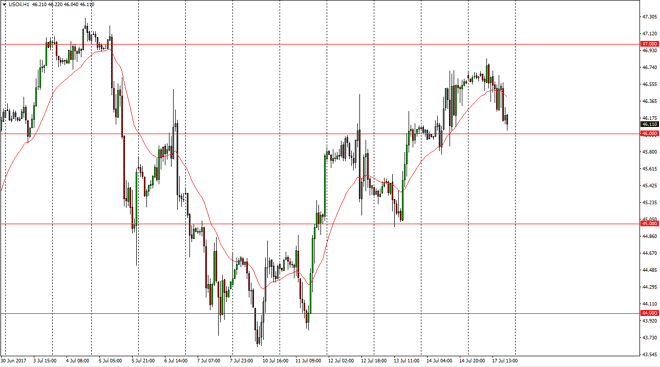

Crude Oil Forecast July 18, 2017, Technical Analysis

Updated: Jul 18, 2017, 06:36 GMT+00:00

WTI Crude Oil The WTI Crude Oil market has rolled over a bit during the day on Monday, testing the $46 level. If we can break down below the $46 level,

WTI Crude Oil

The WTI Crude Oil market has rolled over a bit during the day on Monday, testing the $46 level. If we can break down below the $46 level, it’s likely that we will continue to drop towards the $45 level. I believe that the market is trying to roll over, and if we break down below the level, I think that we will then go much farther. After all, we still have a significant number of headwinds when it comes to the crude oil markets, and I think it’s only a matter of time before that plays itself out in the markets. I believe that the $47 level above is massively resistive, but a break above there could send this market looking towards the $50 level above there, which is even more resistant.

Crude Oil Video 18.7.17

Brent

Brent markets rolled over during the session as well, as the $49 level has offered resistance. I think that if we can reach towards the $48 level, a move below there would be the beginning of the next move lower. Rallies are still to be sold, and I believe that the $50 level above is the absolute “ceiling” in the market. Ultimately, I think that the oversupply of crude oil continues, so it’s only a matter of time before the sellers get involved. Obviously, the US dollar has a certain amount of influence in this market, so we could see of react accordingly. However, I think that the oversupply is a longer-term issue that oil producing countries will continue to struggle with, and because of this I think that buying is something that is probably left to traders that are willing to trade countertrend. I am not one of them, so I’m just looking for exhaustion to get involved with.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement