Advertisement

Advertisement

Crude Oil Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:11 GMT+00:00

Crude oil markets were initially very bullish during the trading session on Tuesday, perhaps fueled by the riots in Iran, but have given back most of the gains to fill the gap. The question is now where do we go?

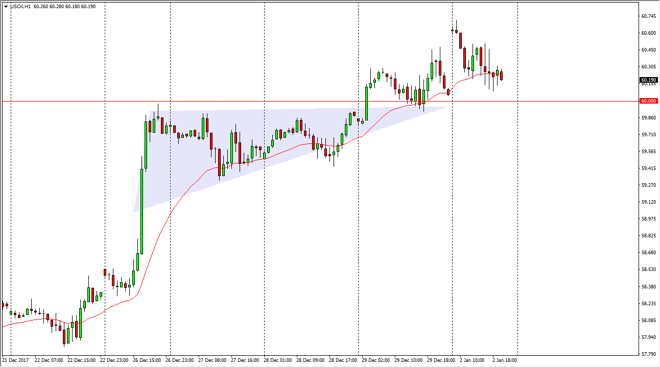

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Tuesday, reaching towards the $60.75 level, but turned around to fall towards the $60 level. That was the bottom of the gap, and we have found buyers there. If the $60 level underneath offers enough support, we should continue to go higher, and continue the uptrend overall. I think that the next target will be the $62.50 level, an area that has been psychologically important in the past, and structurally as well. Because of this, I think that short-term pullbacks are buying opportunities unless of course we were to break down below the $60 level for any significant amount of time. I like the idea of buying dips, at least in the short term as the oil markets certainly have shown quite a bit of buying pressure.

Crude Oil Video 03.01.18

Brent

Brent markets gapped higher as well, but then pulled back significantly to reach towards the $66.25 level. By doing so, we tested an area that has been supportive in the past, so I think we may rally from here. If we do, the market should go back to the $67.25 level next, and then perhaps the $70 level if we get enough momentum. A breakdown below here will find support at the $65 level underneath, which was previously resistance. I think that the market in general continues to look relatively strong, but volatile to say the least as the oil markets have so many competing influences, such as the Iranian riots, US dollar, and of course demand.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement