Advertisement

Advertisement

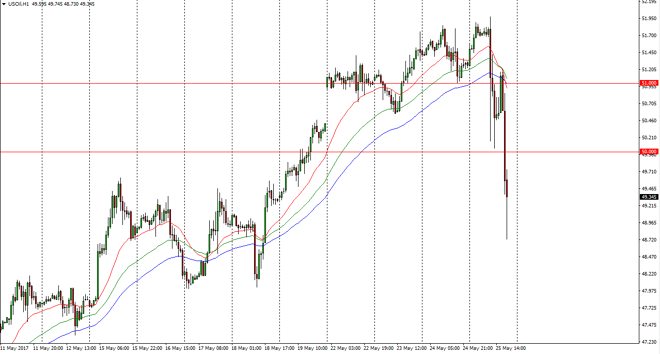

Crude Oil Price Forecast May 26, 2017, Technical Analysis

Updated: May 26, 2017, 04:05 GMT+00:00

WTI Crude Oil The WTI Crude Oil market fell significantly during the day on Thursday, as the extension to the production cuts were announced. This was a

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Thursday, as the extension to the production cuts were announced. This was a bit of a “so on the news” scenario obviously, and now we are drifting lower. I think that the market will continue to be very volatile, as we are dealing with production cuts, but at the same time we have shale producers jumping into the marketplace and offering plenty of supply. Because of this, I think that longer-term we remain susceptible to pullbacks, but this will be a lot of back and forth trading. I suspect that the $48.50 level could offer a little bit of support, but I think you are probably going to be better off staying away for the next session or so.

Crude Oil Forecast Video

Brent

Brent markets also sold off and now look very bearish. If we can break down below the $51 level, this market should continue to go much lower. A bit of a snapback rally could happen, as we continue to see volatility. The extension of the production cuts was exactly what the markets were hoping for, and anticipating. The fact that this was essentially no new news brought less bullish pressure into the marketplace. If we break down below the $51 level, we then go to the $50 level. This is a market that looks suddenly very susceptible to selling pressure again, as quite frankly OPEC doesn’t have the ability to control pricing anymore. Every time they do bring up the price of crude oil, the main beneficiary of that is going to be the American and Canadian shale oil producers, as they are more than willing to jump into the market at these higher prices. Oil continues to be messy.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement