Advertisement

Advertisement

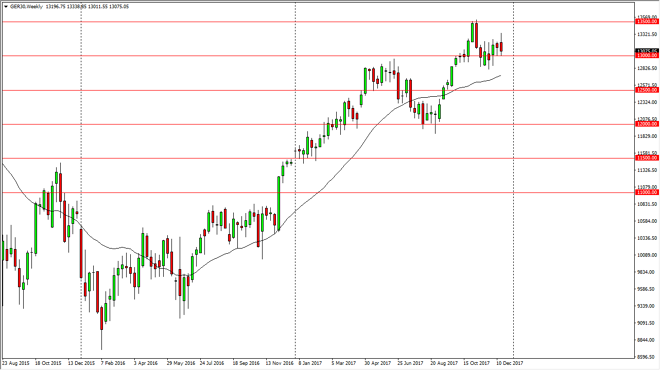

DAX forecast for the week of December 25, 2017, Technical Analysis

Updated: Dec 23, 2017, 06:59 GMT+00:00

The German index had a rough week, but we see plenty of support just below at a large, round, psychologically significant number, as well as a certain amount of structural support.

The German index initially rally during the week, but then rolled over significantly to slam into the €13,000 level underneath. The €13,000 level is an area that’s been supportive, but then again, it’s been resistive in the past. This is a continuation of the longer-term break out that we had seen during the fall, and I think that we are going to continue to see buying pressure to the upside, perhaps reaching towards the €13,500 level after that. A break above that level turned this into more of a “buy-and-hold” scenario where we go looking towards the €15,000 level, which is my longer-term target.

I have no interest in shorting this market until we break down below the €12,000 level, which is something that doesn’t look very likely to happen anytime soon. I believe that the overall bullish pressure in the DAX should continue as it is the main gateway for most traders who want to be involved in the European Union, as the German economy is by far the largest economy in the EU itself. Essentially, as Germany goes, so does the European Union.

The EUR/USD pair is ready to take off to the upside, but it is still historically cheap, thereby making German exports a reasonable value for most customers around the world, which of course will help drive corporate profits coming out of Germany. That in the end will be a major driver to the upside of the DAX going forward, but this next week could be a bit odd as liquidity will be an issue between holidays.

DAX Video 25.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement