Advertisement

Advertisement

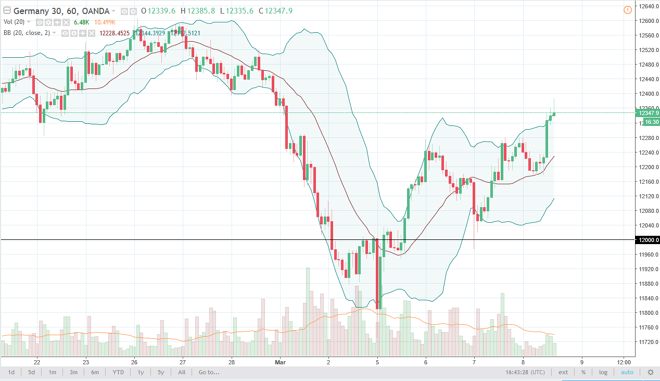

DAX Index Forecast March 9, 2018, Technical Analysis

Updated: Mar 9, 2018, 06:33 GMT+00:00

The German index shot higher during the trading session on Thursday, reaching as high as €12,375 before pulling back a bit. This is the latest “higher high” in the market, and I think it shows that we are going to continue to see buyers overall.

The DAX had a decent trading session during the day on Thursday, getting over half a percent before pulling back just slightly. This has produced a “higher high”, which is a scenario for a nice uptrend. I believe that the DAX will continue to lead the way for most of the European continent, and with the ECB suggesting that perhaps they were stepping away from the idea of tightening anytime soon, and that should continue to inflate asset prices on the continent. This of course helps the DAX as it is considered to be the “blue-chip” index.

With the rising US dollar, that will also help the export sector in Germany flourish, so I think that the DAX will continue to see buyers come into the marketplace and take advantage of what is a structurally strong market anyway. Overall, I believe that the market participants remain bullish and optimistic, so therefore it is likely to be a scenario where traders continue to buy the dips. I believe that the €12,250 level will be the next major support level, and any bounce from that region should be nice buying opportunity. Obviously, if we make a higher high that would also be another bicycle. I have no interest in shorting the DAX, I believe that we continue to go much higher as the €12,000 level starts to offer a bit of a floor again in a market that has been quite bullish longer term. A breakdown to a fresh, new low would of course change everything, but we aren’t anywhere near that right now.

DAX Video 09.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement