Advertisement

Advertisement

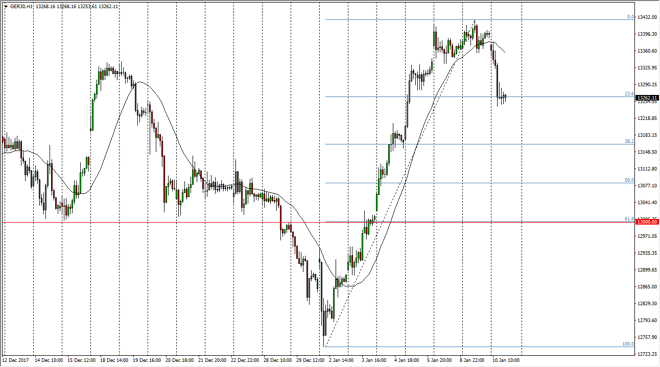

DAX Index Price Forecast January 11, 2018, Technical Analysis

Updated: Jan 11, 2018, 05:17 GMT+00:00

The DAX market gapped lower at the open on Wednesday, and then shot down to the €13,250 level. As an area that obviously is a round number, but it is also the 23.6% Fibonacci retracement level from the recent rally that we have had.

The German index gapped lower at the open on Wednesday, and then fell apart, reaching towards the €13,250 level. This is an area that of course will attract some attention, as it is a large, round, psychologically significant number. Beyond that, it’s the 23.6% Fibonacci retracement level, which of course is a slight area of interest. With a little bit of momentum, I believe that the market probably goes looking towards the €13,400 level, and then eventually the €13,500 level. Even if we pull back from here, I believe it’s only a matter of time before we go to the upside, and therefore I’m looking at these dips as potential buying opportunities. The DAX of course has been a place for a lot of traders to place money when it comes down to the European Union. The DAX represents Germany of course, and that represents over 80% of the totality of the EU.

I believe that the 38.2% Fibonacci retracement level underneath will also be supportive, so if we did breakdown, I will be looking for buying opportunities near the €13,150 level. Ultimately, the market should have a “floor” at the €13,000 level, and I believe that if we can stay above that area, the uptrend is intact, regardless of how volatile things may get. Remember, the EUR/USD pair can have an influence on this market as well, as the cost of German exports is directly influenced by that as well. If the EUR/USD pair rally’s to significantly, that can put a dragon this market.

DAX Video 11.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement