Advertisement

Advertisement

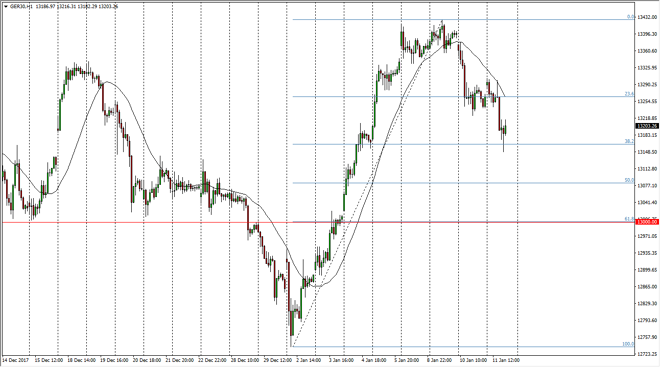

DAX Index Price Forecast January 12, 2018, Technical Analysis

Updated: Jan 12, 2018, 05:00 GMT+00:00

German traders were sellers during the trading session on Thursday, reaching down to the €13,150 level, and then stalling a bit. The 38.2% Fibonacci retracement level underneath is an area that could cause a bit of a bounce, but quite frankly I think that even if we break down below there, the 50% Fibonacci retracement level near the 13,100 level will also be important. I look at the €13,000 level as the “floor.”

The German index has pulled back a bit during the trading session on Thursday, but having said that it’s very likely that the market will find support in this area, as we are at the 38.2% Fibonacci retracement level. Below there, we have the 50% Fibonacci retracement level, and more importantly: the 61.8% Fibonacci retracement level at the large, round, psychologically significant figure – €13,000. Ultimately, I am waiting to buy the DAX, but I don’t see a reason to do so quite yet. I think that a bullish day is probably needed, and then we can casually add a move to the upside, and then go towards the €13,450 level, and eventually go higher towards the €14,000 level. I believe in the DAX longer-term, but we may have gotten a bit of negativity in the market based upon the Euro rallying during the day, making German exports a little bit more expensive.

If we were to break down below the €13,000 level, that would be very negative and I would anticipate that the market would do a 100% pullback to the initial point of the rally at €12,750. That would be very negative sign, and I think that we could even go lower than that. A break below that level would send this market to the €12,500 level, and then eventually the €12,000 level. However, the DAX looks very healthy.

DAX Video 12.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement