Advertisement

Advertisement

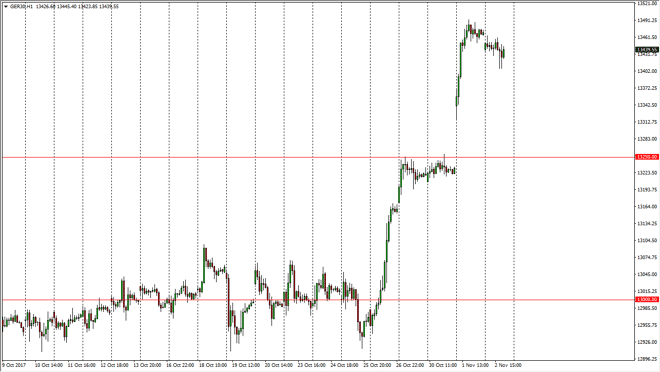

DAX Index Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:20 GMT+00:00

The German index gapped lower at the open on Thursday, but then pulled back slightly to reach towards the €13,400 level underneath. The way, I think that

The German index gapped lower at the open on Thursday, but then pulled back slightly to reach towards the €13,400 level underneath. The way, I think that the market has a massive gap underneath that will eventually get filled, meaning that we are likely to drip down towards the €13,250 level underneath. That is an area that should be massively supportive, and I believe that any time we pull back to that area it’s likely that the buyers continue to jump in and flood the market with upward pressure. If the market breaks above the €13,500 level, then we are free to go to the €14,000 level after that. The €13,250 level should offer a bit of a “floor” in the market, after the gap that of course had been so bullish.

The EUR/USD pair has been negative as of late, and that has been helping the German export market. The EUR/USD pair will more than likely react to the jobs number coming out of America, as it should send the US dollar in one direction or another. If the US dollar rallies, that should drive the value of the Euro down, sending this market much higher. Pay attention to that jobs number, it will have a certain amount of knock on effect when it comes to the DAX, sending it to the upside with a strengthening US dollar. The market breaking below the €13,250 level would be very negative, perhaps sending the market down to the €13,000 level after that. Volatility continues to be an issue with markets overall, but this is one of the more stable markets that I have been following as of late, so I am very bullish and very optimistic, looking at pullbacks to pick up the DAX “on the cheap.”

DAX Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement