Advertisement

Advertisement

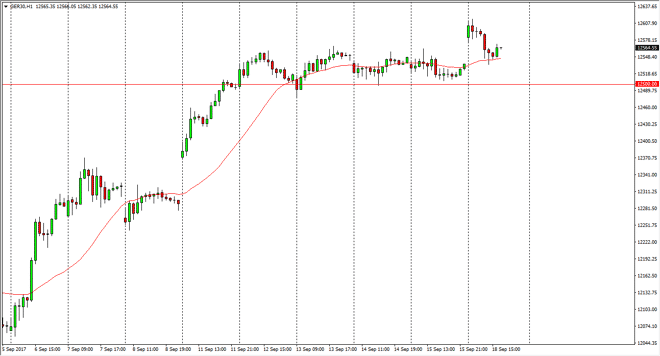

DAX Index Price Forecast September 19, 2017, Technical Analysis

Updated: Sep 19, 2017, 05:56 GMT+00:00

The German index gapped higher at the open on Monday, and then turned back around to fill that gap. The gap of course is a bullish sign, and a significant

The German index gapped higher at the open on Monday, and then turned back around to fill that gap. The gap of course is a bullish sign, and a significant support level just below also helps this market as well. The €12,500 level continues to offer support for a market that looks ready to go higher. Because of this, I am very bullish of this market going forward, and I believe that we could go as high as €12,800 in the short term. Ultimately, if we did breakdown below the €12,500 level, I think that we will probably go looking towards the €12,300 level below, which was the scene of a gap several days ago. Either way, I feel that this is a market that is to be bought on the dips, and I have no interest in shorting. Granted, the EUR/USD pair has been skyrocketing as of late, and that does make German exports a bit more expensive, but at the end of the day I think that a lot of what we’re seeing in this chart should do with true strength in the European Union.

DAX Video 19.9.17

Buying dips

I continue to buy dips in this market, as I believe that the DAX will lead the way for the rest the European Union and perhaps even beyond there. With this, the market I think eventually goes to the €13,000 level, but it’s going to take a while to get there. If we do get above that level, then the next longer-term target would be the €15,000 level. I don’t have any interest in shorting, least not until we were to break down below the gap from several sessions ago, which would have me selling somewhere near the €12,250 level. Overall, the DAX is one of my favorite indices right now.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement