Advertisement

Advertisement

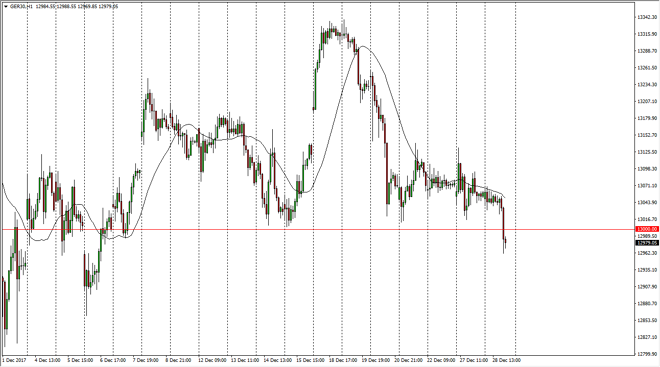

DAX Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:57 GMT+00:00

The German index fell during the trading session on Thursday, breaking below the €13,000 level. By doing so, that is a negative sign, but I see plenty support down to the €12,800 level.

The German index fell slightly during the trading session, but most importantly broke down below the €13,000 level. I think that the market is well supported down to the €12,800 level, as I have been saying for a while. I think that the market will probably bounce, but is not until we break above the €13,000 level that I feel comfortable buying again. Eventually, the market should go to the €13,350 level, which has been resistance in the past. If we can break above there, I think that the market then goes to the €15,000 handle. Alternately, if we were to break down below the €12,800 level, the market should then go down to the €12,500 level.

The trading markets are very thin right now, and of course we have the headline risk coming out of the UK and the EU negotiating the exit, so that could have a bit of noise coming into the market occasionally, but the longer-term the DAX will continue to be one market that is heavily supported, because it is essentially the “blue-chip index” of the European Union overall. I think that the volatility is something that you can overlook over the last couple of sessions, because we haven’t made a significant move, as the volume just simply is not there. The market looks likely to be one that you need to look at from a longer-term standpoint, and that means adding slowly. I would not jump into the marketplace with both feet, at least not until after the holidays, and perhaps even the nonfarm payroll number in January.

DAX Video 29.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement