Advertisement

Advertisement

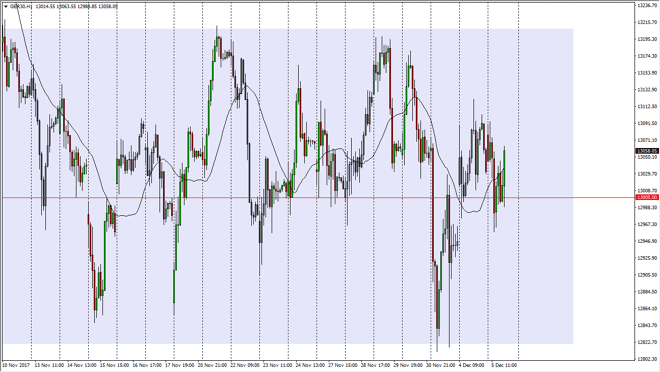

DAX Price Forecast December 6, 2017, Technical Analysis

Updated: Dec 6, 2017, 06:58 GMT+00:00

The German index has been very noisy during the trading session on Tuesday, initially falling towards the €13,000 level, and then filling a gap. However, things are changing as I record this.

The German index initially fell during the trading session on Tuesday, looking for the gap at the €12,950 level. We found enough buyers there to turn things around and form a bullish looking move. The daily candle looks as if it could end up being a bit of a hammer, which sits right at the €13,000 level. That’s a very bullish sign, and therefore think it’s only a matter of time before the DAX rallies from here and goes looking towards the €13,200 level after that. A break above that should send the market towards the €13,500 level as we have seen previous desires to reach towards before, and therefore gives us a nice-looking target.

The market rolling over from here will probably have sellers looking for the €12,800 level. That’s an area that should be massively supportive, and essentially the “floor” in the market. Given enough time, I do believe that the buyers continue to go into the market and push higher, as the German index tends to be an initial place for money to flow into the European Union. I believe that longer-term, we will not only go looking towards the €13,500 level, but we will break above there, offering a nice a buy-and-hold scenario. If we were to somehow break down below the €12,800 level, at that point the next target would be €12,500, followed very quickly by the €12,000 level which is the absolute “floor” in the longer-term uptrend. At that point, we would enter a market that we should continue to start selling again as it would be a serious route in the DAX.

DAX Video 06.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement