Advertisement

Advertisement

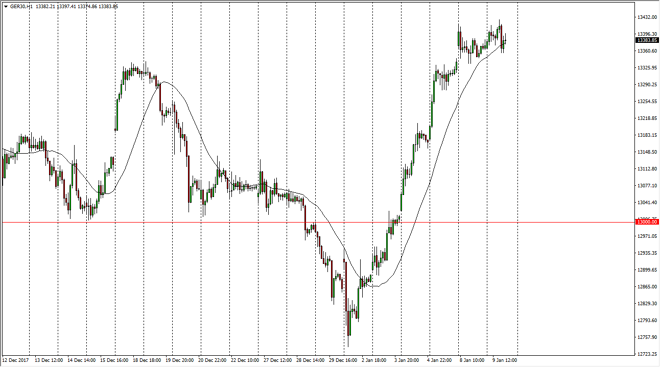

DAX Price Forecast January 10, 2018, Technical Analysis

Updated: Jan 10, 2018, 04:13 GMT+00:00

German traders went back and forth during the trading session on Tuesday, showing signs of volatility. We continue to see the gap from a couple of sessions ago offer an opportunity for support, even though the market is a bit overextended. The 24-hour exponential moving average is catching up to price now, so we will have to see if the impulsive move can continue.

I believe that the German index will continue to be one of the better performers in the European Union, although it has been a bit slow over the last couple of sessions. That’s not a huge surprise, because we have such a massive Ron higher previously, that we may need to take a bit of a breather. That gives traders the opportunity to perhaps add to their positions in a slow manner, or at least just catch their breath. I think that the 13,500 level is likely to be targeted next, although it may be a volatile ride to that level. I would not be surprised at all to see a pullback, but that pullbacks should do nothing but offer value for traders out there as we are obviously bullish.

I suspect that the €13,000 level offers the “floor” in the market, moving up from the previous floor at the €12,500 level. The market has seen a fresh, new high over the last couple of weeks, so it makes sense that we would see a continuation of the move. However, the marketplace can’t go straight up in the air as it has without taking a break, so that’s essentially what my thesis is, that we are going to continue to see plenty of reasons to go higher, but the momentum is slowing as exhaustion sets in. Eventually, we should get another catalyst and that is what will be needed to add to a core position.

DAX Video 10.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement