Advertisement

Advertisement

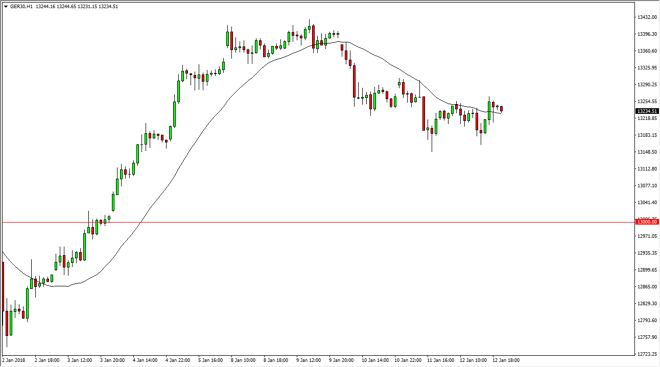

DAX Price Forecast January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 02:59 GMT+00:00

The German index went sideways during most of the session on Friday, bouncing around the €13,250 level. The market should continue to go higher longer-term, but I think that it’s obvious that the market may need to catch his breath in the short term.

The German index has gone sideways over the last couple of sessions, as we calmed down after the massive shot higher. I believe that the €13,000 level underneath is going to be a “floor” in the market, and I think that if we can stay above there, the buyers will continue to be attracted to what looks to be a very strong situation. If we can break above the €13,450 level, it would be a fresh, new high, sending the market the much higher levels. Longer-term, I believe that we are going to go looking towards the €15,000 level, which of course is a large, round, psychologically significant figure itself.

Is not until we break below the €13,000 level that I would be worried about this market for a short-term perspective, and I believe that as long as the money is willing to flow into the European Union, the DAX will be one of the first places they go to. I think that every time we dip, it’s likely that it will be a buying opportunity, and this gives us an opportunity to add to a core position that you build over time. The EUR/USD pair has broken above a significant amount of resistance, which could be a bit of a drag to the toll German exports. That being the case though, I think it’s only a minor issue as the DAX continues to represent the European Union on the whole. Again, we could get noise, but every time we dip and add slowly, we could build up a large position to take advantage of what I think is significant momentum.

DAX Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement