Advertisement

Advertisement

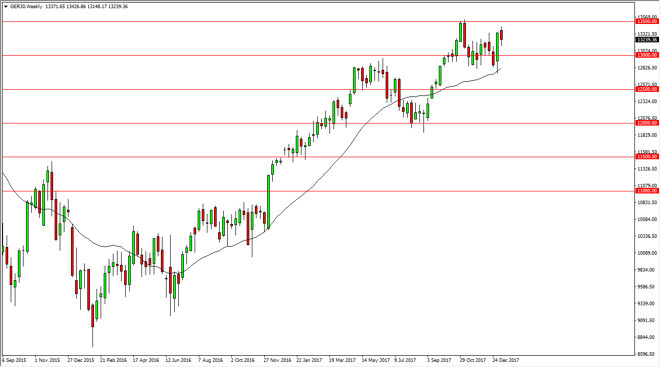

DAX Price forecast for the week of January 15, 2018, Technical Analysis

Updated: Jan 13, 2018, 03:07 GMT+00:00

The German index fell during the week, but towards the end of the week we started see buyers get involved and bounce the market a bit. Ultimately, the €13,500 level above is massively resistive, but eventually I think we will break out to the upside.

The German index was a bit negative during the week, but quite frankly we are consolidating. I think there is a certain amount of support below at the €12,800 level, which is the bottom of the tight range. I think pullbacks represent the value that we will be taken advantage of, to build up enough momentum to break above the €13,500 level. Once we break above there, the market should then go looking towards higher levels such as the €15,000 handle. This is a market that has been very bullish for quite some time, and of course represents the European Union in general via the stock market. The German economy represents over 80% of the output, so it makes sense.

It is not until we break down below the €12,750 level that I would consider selling, and even then, I would be a bit cautious to do so. Longer-term, I believe that the DAX will chase the €15,000 handle, and perhaps beyond. I would anticipate a massive amount of resistance there, but this will be the target over the next several months, perhaps some time during the summer.

The volatility probably favors daily charts, if not the 4-hour chart. This market continues to see plenty of buyers when value presents itself, as it is the best way to invest in European expansion. Beyond that, if you trade other indices pay attention to the DAX as it tends to lead the MIB, Ibex, CAC, and other markets around the European Union.

DAX Video 15.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement