Advertisement

Advertisement

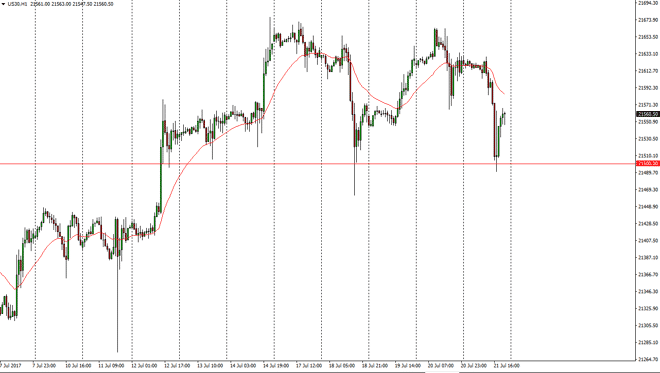

Dow Jones 30 and NASDAQ 100 Forecast July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:04 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially went sideways during the day on Friday, but fell significantly to reach down towards the 21,500 level. The market

Dow Jones 30

The Dow Jones 30 initially went sideways during the day on Friday, but fell significantly to reach down towards the 21,500 level. The market bounced from there significantly, and it now looks as if we are going to continue to go higher. I think that longer-term, the 21,500 level should offer support, and I think that eventually we will reach towards the highs again. Longer-term, I believe that buying on dips is the best way to go in this market place, as the US dollar continues to lose value in general. I believe this market is heavily supported at the 21,500 level, and it should offer a bit of a “floor” in the market. Volatility continues, but I still believe in the upside in general.

Dow Jones 30 and NASDAQ Index Video 24.7.17

NASDAQ 100

The NASDAQ 100 went sideways initially, but found enough support at the 5900 level underneath to turn things around and continue to show buying pressure. I believe that given enough time we should reach towards the 6000 handle. That’s a large, round, psychologically significant number, and of course attractive to traders longer term. I believe that pullbacks offer value, and the NASDAQ 100 looks set to become a leader in the US stock markets overall as it has been in the past. I have no interest in shorting, I think that the market is heavily supported underneath, and even though we saw some negative action on Friday and other indices, the NASDAQ 100 held up quite strong in comparison to the other major indices. Ultimately, the market reaches the 6000 level, and then breaks above there.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement