Advertisement

Advertisement

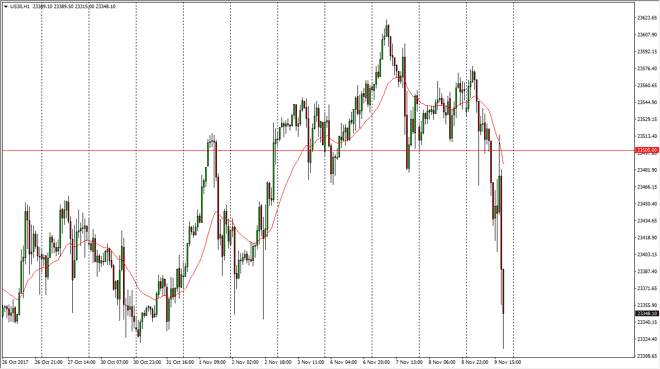

Dow Jones 30 and NASDAQ 100 Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:35 GMT+00:00

Dow Jones 30 The Dow Jones 30 fell significantly during the trading session on Thursday, as stock markets around the world got be down a bit. In the

Dow Jones 30

The Dow Jones 30 fell significantly during the trading session on Thursday, as stock markets around the world got be down a bit. In the United States, the biggest problem was the tax bill looking less likely, least in the short term, and that being the case we sliced through the 23,500 level rather quickly. We broke down below there, reaching towards the 23,350 level. I think given enough time, we should see some stability, but quite frankly I would prefer to see what happens over the next 24 hours before I would even remotely try to put together a training thesis. There will be a lot of noise over the weekend as well, so keep that in mind, and therefore it might be best to sit on the sidelines until Monday.

Dow Jones 31 and NASDAQ Index Video 10.11.17

NASDAQ 100

The NASDAQ 100 has rolled over as well, but looks a little bit healthier in comparison to the Dow Jones 30. I think that the 6200-level underneath is the “floor” in the market, and I think that it’s only a matter of time before the buyers return. Ultimately, this is a market that should eventually reach towards the 6300 level, and then go even higher. This is a market that continues to be bullish longer-term, but I think it’s in desperate need of some type of pullback to offer value. That’s exactly what we are getting, and I am in no rush to jump into the market. Overall, I’m a buyer, but I need to see some type of stability on the daily charts, and may wait until after the weekend in this market as well, as I think there are so many issues that could come into play soon.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement