Advertisement

Advertisement

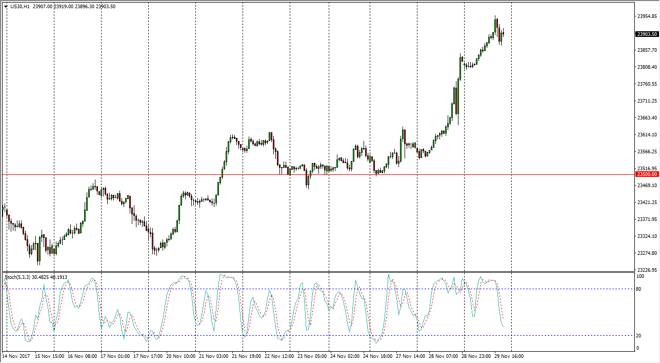

Dow Jones 30 and NASDAQ 100 Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:06 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially rallied on Wednesday, reaching towards the 24,000 level before pulling back. We did see a bit of a bounce after

Dow Jones 30

The Dow Jones 30 initially rallied on Wednesday, reaching towards the 24,000 level before pulling back. We did see a bit of a bounce after the pullback, so I think this continues to be a “buy on the dips market as we find plenty of buyers jumping in. I also recognize that the 23,800 level should be supportive, but in the meantime although we may get volatile, the buyers are certainly much more aggressive and closer to being in control than any selling pressure that we have seen as of late. I believe that the “floor” in the overall market is closer to the 23,500 level, and if we can stay above there the bull case remains for the Dow Jones 30, as liquidity continues to flow in the stock markets.

Dow Jones 30 and NASDAQ Index Video 30.11.17

NASDAQ 100

The NASDAQ 100 plunged rather significantly during trading on Wednesday, slicing through the 6400 level, and going as low as 6300 before bouncing slightly. The stochastic oscillator is starting to cross in the oversold region, so we could see a bit of a bounce, but right now I would be a bit hesitant to jump into this market. Quite frankly, if you want to play the US stock markets it’s obvious that the Dow Jones 30 is much more stable, and at the end of the day that’s what you want to see if you’re going long of the equity markets as they have been overextended for some time. If we were to break down below the 6275 level, I think at that point we could be looking at a move down to the 6225-level next. The NASDAQ 100 looks very susceptible to selling pressure suddenly, and therefore I am very leery.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement