Advertisement

Advertisement

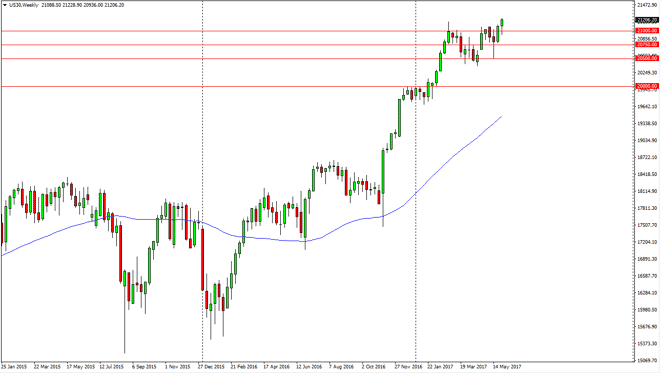

Dow Jones 30 and NASDAQ 100 Price Forecast for the Week of June 5, 2017, Technical Analysis

Updated: Jun 4, 2017, 07:14 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially fell during the week, but found enough support below the 2100 level to turn around and form a nice-looking hammer.

Dow Jones 30

The Dow Jones 30 initially fell during the week, but found enough support below the 2100 level to turn around and form a nice-looking hammer. Because of this, I believe that the market is going to continue to go higher, as we have broken out of the consolidation area. The market has made a fresh, new high, and I think we continue to find buyers every time we dip. The market should then go to the 22,000 level, and beyond. The Dow Jones 30 market has been very bullish in general and I think that the market will continue to find any opportunity I can to go long and find a bullish reason to be involved. Selling is all but an impossibility at this point in time.

Dow Jones 30 and NASDAQ Index Video 05.6.17

NASDAQ 100

The NASDAQ 100 initially tried to fall during the week but also broke above the 5800 level. I think there is not much to keep this market from going to the 6000 level, and even if we pulled back, it’s not until we break below the 5500 level that I would be interested in selling this market. We are bit overdone to the upside, but quite frankly there’s no way to fight this trend. Selling is impossible, so this is a buy on the dips type of situation going forward, and that is something that I don’t see changing anytime soon. The 6000 level above could be massively resistive, so that might be the actual catalyst to have that pullback that so desperately needed, but to be honest is probably going to be easier to simply let the market pull back and just buy on dips. I would be very cautious about selling.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement