Advertisement

Advertisement

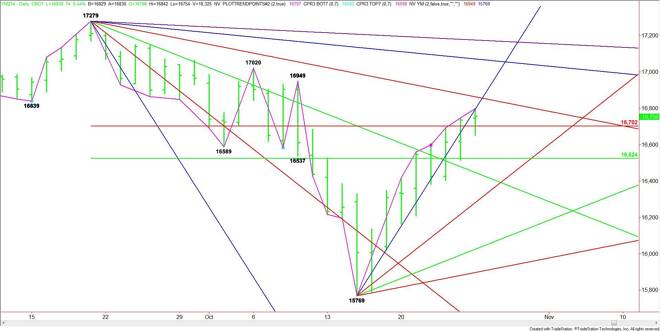

E-mini Dow Jones Industrial Average (YM) Futures Analysis – October 28, 2014 Forecast

By:

December E-mini Dow Jones Industrial Average futures closed higher on Monday, but the weak trade suggests that upside momentum may be slowing. This should

December E-mini Dow Jones Industrial Average futures closed higher on Monday, but the weak trade suggests that upside momentum may be slowing. This should be no surprise since the market is up nine days from the bottom, putting it in the window of time for a potential top. Traders should closely monitor the intraday charts for signs of topping action including “M” formations or closing price reversals.

The first upside target today is a downtrending angle at 16847. The most important, however, is a steep uptrending angle at 16921. Overtaking this angle and sustaining the move will mean the upside momentum is intact. This could lead to a test of the main tops at 16949 and 17020. A trade through these levels will turn the main trend to up on the daily chart.

If 17020 is taken out then look for a drive into downtrending angles at 17063 and 17171. This angle is the last resistance before the 17279 main top.

A failure at 16847 will be a sign of weakness. This could lead to a test of the Fibonacci level at 16702. Watch for an acceleration to the downside if 16702 fails as support since the next potential target is the 50% level at 16524.

The tone of the market today will be determined by trader reaction to 16847.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement