Advertisement

Advertisement

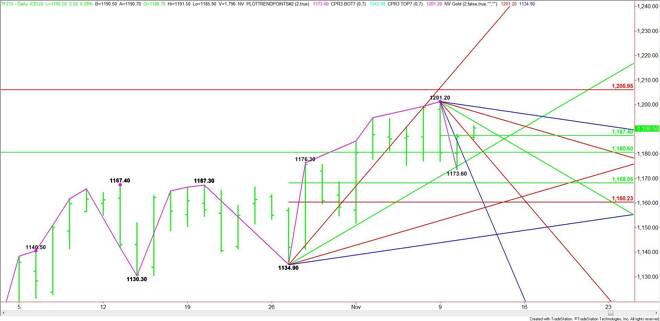

E-mini Russell 2000 Index (TF) Futures Technical Analysis – November 11, 2015 Forecast

By:

December E-mini Russell 2000 Index futures are trading higher shortly before the cash market opening. Yesterday, the index broke sharply, but was able to

December E-mini Russell 2000 Index futures are trading higher shortly before the cash market opening. Yesterday, the index broke sharply, but was able to recover into the close. This upside momentum continued into today’s pre-market session.

Today is a U.S. bank holiday so it may be difficult to gauge the strength or weakness of the market because of the expected low volume. In other words, be careful buying breakouts and selling breakdowns.

Technically, the main trend is up according to the daily swing chart.

The short-term range is 1201.20 to 1173.60. Its 50% level or pivot comes in at 1187.40. Trader reaction to this level will set the tone for the day. Currently, the index is trading above it, giving it an early upside bias.

A sustained move over 1187.40 will indicate the presence of buyers. There may be a labored rally because of a series of downtrending angles at 1193.20, 1197.20 and 1199.20. The latter is the last potential resistance angle before the 1201.20 main top.

A sustained move under 1187.40 will signal the presence of sellers. Crossing to the weak side of a downtrending angle at 1185.20 could trigger an acceleration to the downside into a major 50% level at 1180.60. This is followed by the uptrending angle that stopped the break on Tuesday. This angle is at 1178.90 today.

Crossing to the weak side of the angle at 1178.90 will indicate the selling pressure is getting stronger. The primary downside target remains the retracement zone at 1168.00 to 1160.25.

Watch the price action and read the order flow at 1180.60 today. Trader reaction to this level will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement