Advertisement

Advertisement

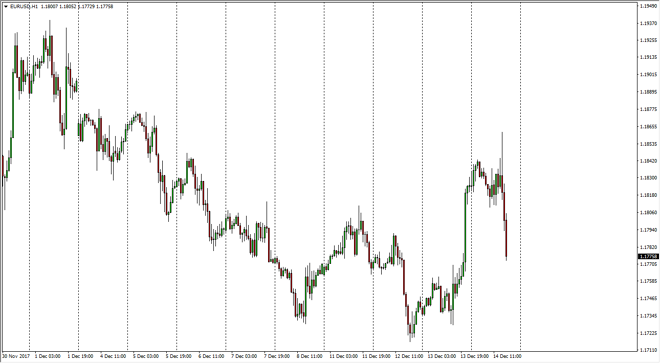

EUR/USD Price Forecast December 15, 2017, Technical Analysis

Updated: Dec 15, 2017, 06:27 GMT+00:00

The EUR/USD pair had a volatile session during the trading session on Thursday, as the ECB had an interest rate announcement, causing a lot of noise in the market. However, it’s likely that we continue to see support just below.

Unless the longer-term outlook for the pair has changed, the volatility that we have seen during the trading session on Thursday should be a buying opportunity by the time everything is said and done. Because of this, I believe that the support area near the 1.1775 level could be an area where value comes back into play. This has been a rather significant move, but if we can break above the 1.18 handle, I believe that the market will continue to go to the upside, and when I look at the weekly chart I recognize that we are in the middle of a bullish flag, or at least trying to form it. That bullish flag could lead this market looking to the 1.32 level above, but that’s obviously a longer-term call.

In the meantime, I believe that if we can stay above the 1.17 handle, the market is fine, and that the buyers will eventually return. The Federal Reserve is already known to be in a tightening cycle, but it looks like the market has already taken it in stride. I think that given enough time, this market will rally, based upon growth in the European Union, and the inflation outlook in the European Union being reasonably strong over the next several years. We are well above the 2% mandate that the ECB follows, so a tightening of monetary policy is probably coming. Having said that, it’s likely that the buyers are waiting for the market to settle down, and they will then step in.

EURUSD analysis Video 15.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement