Advertisement

Advertisement

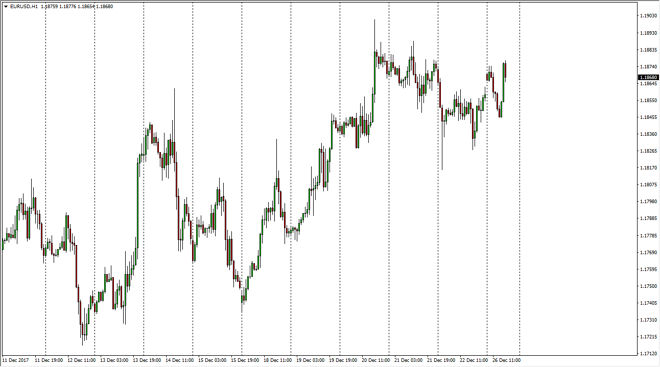

EUR/USD Price Forecast December 27, 2017, Technical Analysis

Updated: Dec 27, 2017, 05:35 GMT+00:00

The Euro continues to be very noisy, but we have seen more bullish pressure than bearish during the trading session on Tuesday, although the volumes would have of course been very thin. Because of this, you can’t read too much into the trading action over the last 24 hours, but certainly the longer-term outlook for the pair is bullish.

The EUR/USD pair rallied significantly during the trading session on Tuesday after initially falling. Because of this, the market ended up basically being more noise than anything else, but when I look at the longer-term charts I make out a nice bullish flag on the weekly chart that is trying to break out to the upside. If we can break above the 1.19 level, the market should continue to go much higher, and possibly even trigger a massive amount of bullish pressure for the longer-term trader as well, with a potential target of 1.32 being obtained. This is my favorite pair to watch for the year, because we could be seeing a major shift happening.

If we break down from here, I would not be concerned until we got below the 1.18 handle. At that point, that doesn’t break the bullish flag completely, but it does say that we need to reset yet again. A move below the 1.17 level kills the flag, and then has me thinking that the pair is going to roll over completely. This would be especially true after the last several sessions being so positive. I believe that we are going to continue to see a lot of volatility until after New Year’s Day, as there is no volume out there to speak of, keeping it a very erratic market in general. We could see a flash crash and the short-term, but eventually I believe the uptrend returns.

EUR USD Forecast Video 27.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement