Advertisement

Advertisement

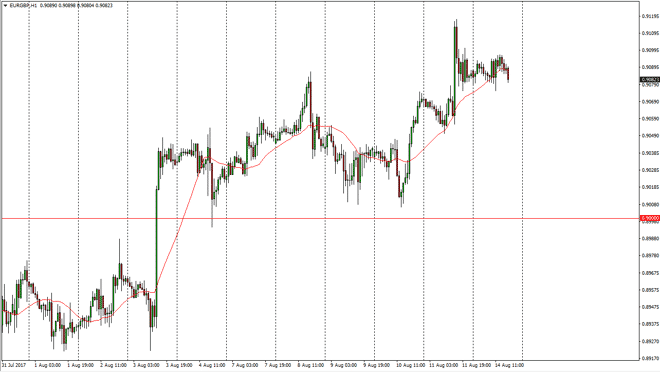

EUR/GBP Forecast August 15, 2017, Technical Analysis

Updated: Aug 15, 2017, 05:19 GMT+00:00

The EUR/GBP pair did almost nothing during the day on Monday, as we continue to drift into the 0.91 handle. I believe that longer-term this market is

The EUR/GBP pair did almost nothing during the day on Monday, as we continue to drift into the 0.91 handle. I believe that longer-term this market is probably going to be positive, simply because most traders are more comfortable with the idea of what will remain of the European Union in contrast to what could happen in the United Kingdom over the next several months. Having said that, I believe that someday this will be one of the greatest pairs to short, but right now we obviously aren’t in that mode. I think that we will find plenty of support just below, and that we will eventually break above the 0.91 handle and go looking towards the 0.92 level above which was so resistive several months back.

Volatility

This is the most dangerous pair to trade currently, mainly because headlines can come out of nowhere from a random comment or negotiation tactic. Because of this, I believe that it’s probably best to build up your position over time, and although I have an upward bias for the next several months, I believe that it is probably best to add slowly as you can increase your position size as you make sure you’re on the right side of the move. The 0.90 level underneath should be massively supportive, and I believe a bit of a “floor” in the market for the short term. I believe that longer-term “floor” is probably closer to the 0.88 level underneath. Regardless, I look at pullbacks as an opportunity to pick up value, but I also realize that this situation governing this pair is fluid at Bass, and will of course have many turns and twists over the next several months as the reality of the split between the 2 economies comes to fruition.

EUR/GBP Video 15.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement