Advertisement

Advertisement

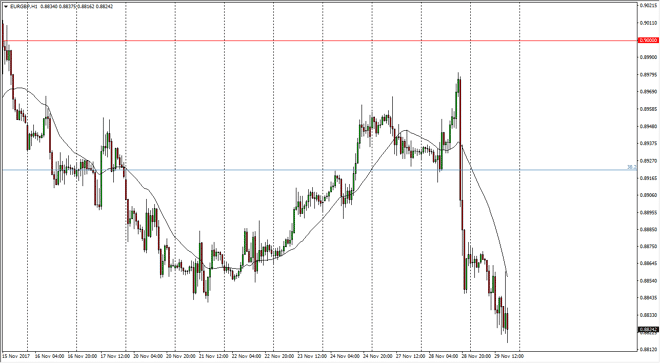

EUR/GBP Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:04 GMT+00:00

The EUR/GBP pair fell a bit during the trading session on Wednesday, as we have a bit more clarity on the fees that the United Kingdom will be paying the

The EUR/GBP pair fell a bit during the trading session on Wednesday, as we have a bit more clarity on the fees that the United Kingdom will be paying the European Union upon exit. Because of this, we rolled over a bit and it looks likely that we are going to have a fight on her hands at the 0.88 level. This is an area that has been rather supportive lately, and of course was an area that found quite a bit of interest. I think we may try to form a bit of a base in this area, and it’s likely that the fact that it has been the bottom of longer-term consolidation also suggests that we could turned right back around.

A breakdown below the 0.88 level would signify more weakness, and could send this market down to the 0.86 handle after that. Because of this, if I see the market break down below the 0.8750 level, I then consider the 0.88 level broken. In the meantime, any sign of a bounce I believe is a buying opportunity as the risk reward ratio is much higher to the upside. After all, even though this has been a significant reversal, when you look at the longer-term charts, there is still a lot of bullish pressure underneath. There are other factors beyond the potential bills for leaving the European Union, which favor the stability of the EU, at least in the short term. I like the idea of buying some type of bounce, as we have a clear target in the form of the 0.90 level above, which of course was the top of the same larger consolidated area. On the breakdown, I believe it could be rather rapid, because it would show a bit of a capitulation.

EUR/GBP Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement