Advertisement

Advertisement

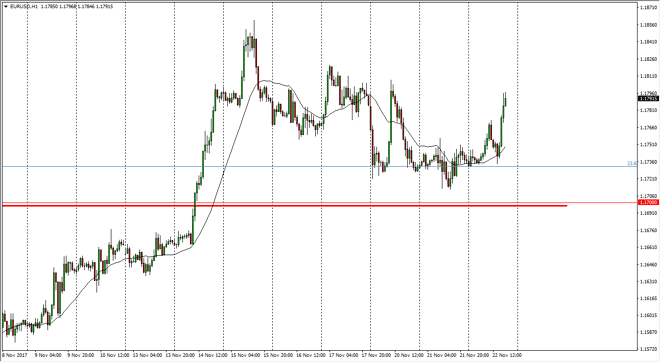

EUR/USD Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:03 GMT+00:00

The EUR/USD pair went sideways at the beginning of the session on Wednesday, but then rallied a bit, only to turn around and fall towards the opening

The EUR/USD pair went sideways at the beginning of the session on Wednesday, but then rallied a bit, only to turn around and fall towards the opening price, before rallying yet again. As I record this, we are testing the 1.18 handle, an area that has a certain amount of importance. I believe that we are going to continue to go higher, as breaking above the previous neckline of the head and shoulders on the daily chart was a very strong sign, and I also believe that there are a lot of concerns when it comes to the U.S. Congress being able to pass some type of meaningful legislation with tax reform. That being said, we also have quantitative easing coming out of the ECB, and that of course puts a bit of a weight around the neck of the Euro itself. Ultimately, I think that this pair continues to be choppy, but I also have a bullish flag marked out on the weekly chart that suggests that you could go to the 1.32 handle above. Longer-term, that has become my target.

I believe in buying pullbacks and dips, and recognize that we could continue to see choppiness, as the pair tends to be headline driven and of course manipulated by algorithmic trading. If we were to break down below the 1.17 level, that would be a very negative sign, and could send this market much lower. However, that becomes a less likely after the Wednesday action, as it shows the resiliency of the support and the buyers underneath. I recognize that the 1.21 level above is significantly resistive, so we may need to pull back several times to build up the necessary momentum to finally get above there. Once we do, becomes more of a “buy-and-hold” situation.

Euro to Dollar Forecast Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement