Advertisement

Advertisement

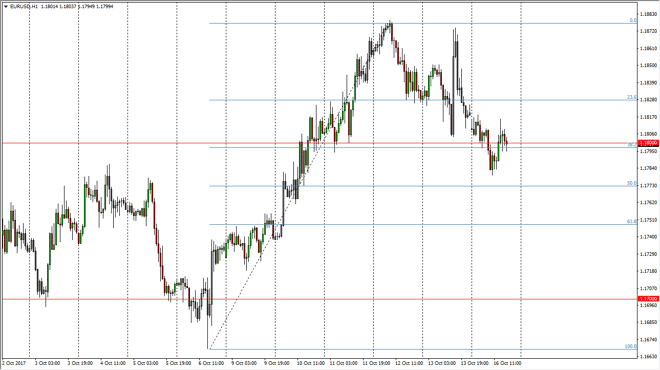

EUR/USD Price Forecast October 17, 2017, Technical Analysis

Updated: Oct 17, 2017, 06:08 GMT+00:00

The EUR/USD pair had a choppy session, initially gapping lower but found enough support near the 1.1780 level to bounce and break above the 1.18 handle

The EUR/USD pair had a choppy session, initially gapping lower but found enough support near the 1.1780 level to bounce and break above the 1.18 handle again. Part of the negativity may be due to the populist prime minister that has been elected in Austria, but quite frankly I think that is more noise than anything else. All things being equal, I believe that the EUR/USD pair should continue to find plenty of buyers, and that this dip to the 38.2% Fibonacci retracement level should be looked at as a potential turn around just waiting to happen. After all, we have been in an uptrend for some time, and although we pulled back, keep in mind that the 1.20 level above is massive resistance. It makes sense that we would have to pull back to try and build up enough momentum to go higher. Once we clear the 1.21 handle, we are in more of a “buy-and-hold” mode.

I think that pullbacks at this point should continue to find support near the 50% Fibonacci retracement level, or the 1.1775 handle, as well. Because of that, I like buying on dips, and I believe that ultimately the Euro will continue to find buyers. I don’t have a scenario in which a willing to sell this pair currently, although I do recognize that the volatility will continue to be very high. Ultimately, I think that the ECB is getting ready to take back some of the liquidity, and that of course helps the currency itself as it’s a sign that the European Union is starting to strengthen. Because of this, I believe that longer-term traders are building positions that they are going to hold on to for quite some time ahead of us.

EUR USD Forecast Video 17.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement