Advertisement

Advertisement

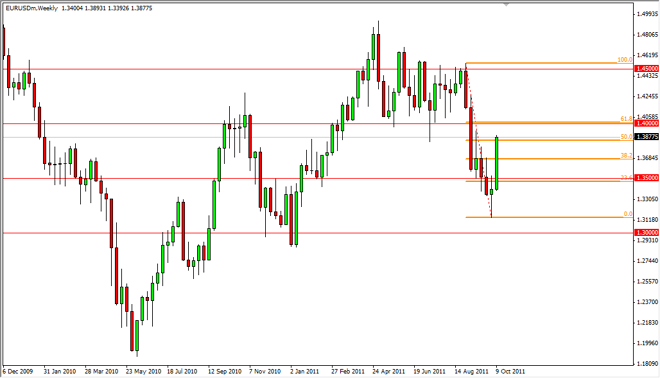

EUR/USD Technical Analysis for the Week of October 17, 2011

Updated: Jan 1, 2011, 00:00 GMT+00:00

The EUR/USD pair rose violently over the course of the week as traders pinned their hopes on some kind of solution for the EU debt issues. The weekend has

The EUR/USD pair rose violently over the course of the week as traders pinned their hopes on some kind of solution for the EU debt issues. The weekend has the G20 meeting in Paris, and it seems to be the hope of the market that the Finance Ministers will come to some kind of agreement. However, these meetings rarely produce much in that way, so disappointment could be in the offering.

The pair has stopped right at the 50% Fibonacci retrace, and is coming up on serious resistance in the form of 1.39 – 1.40. With this in mind, and the headline risks out there, if you aren’t long this pair already – you simply must wait for a daily close above the 1.40 level in order to be protected. However, the pair is in a downtrend still, so buying isn’t our favorite thing to do. What we would really like to see is a gap down on Monday morning, or a failure just below 1.40 in order to short tit. Until we get our signal – expect very choppy trading.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement