Advertisement

Advertisement

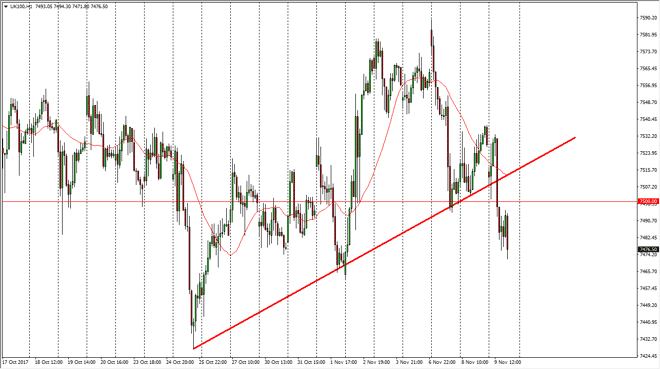

FTSE 100 Price Forecast November 10, 2017, Technical Analysis

Updated: Nov 10, 2017, 04:35 GMT+00:00

The FTSE 100 gapped lower at the open on Thursday, bounced to fill that gap, and then broke down through the uptrend line. More importantly, we also break

The FTSE 100 gapped lower at the open on Thursday, bounced to fill that gap, and then broke down through the uptrend line. More importantly, we also break down below the 7500 level, and it looks as if the FTSE 100 is ready to drop significantly. I think the 7425-level underneath is likely to be the next target, and if we can break down below there, the market is more than likely going to go down to the 7400-level next. Overall, this is likely the beginning of something a little bit uglier, but if we were to break above the previous uptrend line, then it shows that the momentum would continue to the upside. Pay attention to the GBP/USD pair, if it breaks down significantly I think that it’s only a matter of time before the market turns around and rallies in the FTSE 100. However, at this point that would only be speculation, and not sound trading advice.

Overall, I think that perhaps the market had gotten ahead of itself in the longer-term perspective of things, so pullbacks should be healthy. I believe after this move, it’s likely that rallies will be sold, unless of course we get a daily close above the uptrend line, and therefore I would look at signs of exhaustion, especially near the 7500 level, as an opportunity to short this market for a short-term trade. Longer-term, I still fully anticipate the buyers will return, probably at a large, round, psychologically significant number underneath. All things being equal though, breaking below the 7500 level is a significant sign of weakness, as numbers like that typically have a lot of order flow attached to them. By slicing through it, this shows that a lot of stops have been blown out.

FTSE 100 Video 10.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement