Advertisement

Advertisement

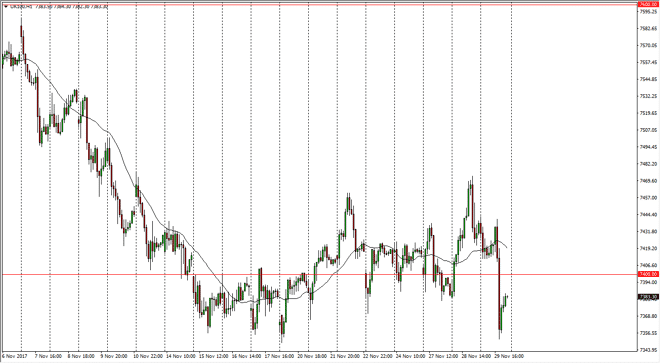

FTSE 100 Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:06 GMT+00:00

The FTSE 100 had a volatile session during the trading session on Wednesday, initially going sideways but then slicing through the 7400 level rather

The FTSE 100 had a volatile session during the trading session on Wednesday, initially going sideways but then slicing through the 7400 level rather rapidly as Teresa May and form the market that there was in fact a no deal with the European Union, so we still have no idea what the cost is going to be for the divorce. Ultimately, I think that we did find support at 7350 yet again, so that tells me that the market is still essentially consolidating around the 7400 handle, which on the longer-term charts is basically “fair value. Ultimately, this is a market that I think you should be playing with a range bound strategy at best, and as a result you could use something like a stochastic oscillator, or perhaps the RSI. Ultimately, I think that every time we pull back like this, buyers will return until we would break below the 7350 handle on a daily close, which for me would be very negative. At that point, I would look at the market is one that is getting ready to go back to the 7200 level, the bottom of the longer-term consolidation.

Alternately, if we rally significantly from here we probably go to the top of the longer-term consolidation area which is the 7600 level. Breaking above there would suggest that the market is ready to make a 400 point move, and gives me a longer-term target of 8000. Ultimately, this is a market that is going to be volatile, so I think that you can take your time to build up a position, and add slowly as the move goes in your favor. I favor the upside longer-term, but I also recognize that headlines could cause quite a bit of noise in the meantime.

FTSE 100 Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement