Advertisement

Advertisement

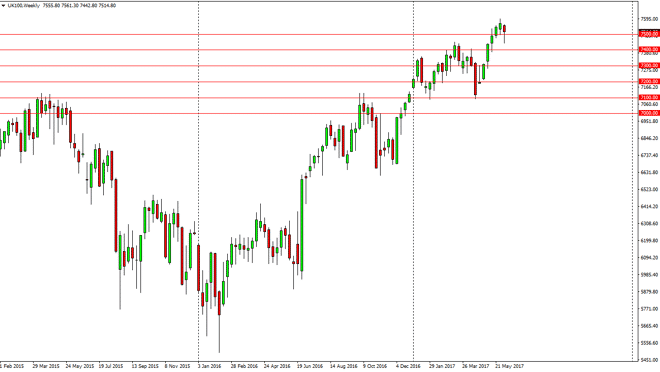

FTSE 100 Price forecast for the week of June 12, 2017, Technical Analysis

Updated: Jun 10, 2017, 04:11 GMT+00:00

The FTSE 100 fell during the week, reaching all the way down to roughly 7425. This of course was exacerbated by the surprise UK elections result, but by

The FTSE 100 fell during the week, reaching all the way down to roughly 7425. This of course was exacerbated by the surprise UK elections result, but by the end of the week we had broken back above the 7500 level, and ended up forming a hammer. This of course is a very bullish sign and it just reinforced the idea that the 7400 level below would be supportive. Because of this, I believe that a break above the top of the range for the week should be yet another buying signal. The 7600 level will be a target, and pullbacks continue to offer value. After all, the British pound is historically week, and that of course helps with exports, a mainstay of this index. Ultimately, this is a market that I have no interest in selling because of the massive amount of support that we have seen just below.

Buying the dips

We are in a longer-term uptrend, and therefore it means that we should be buying the dips. I think that the market will continue to show bullish pressure and I do believe that we will eventually be talking about 8000. Obviously, it will take some time to get there and there are a lot of headlines they can move this market around as the United Kingdom contemplates the move from the European Union, but historically speaking, any weakness in the British pound should help this market. So, with that being said I believe that there is more risk to the upside than the down, so I remain bullish. In fact, I don’t even have a scenario in which I’m selling this index anytime soon as I have seen so much in the way of positive momentum.

FTSE 100 Video 12.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement