Advertisement

Advertisement

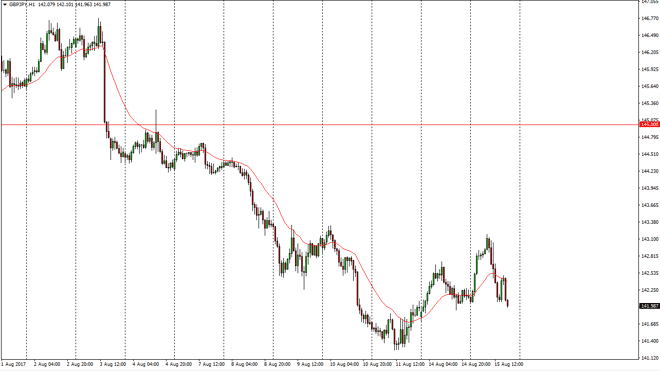

GBP/JPY Price Forecast August 16, 2017, Technical Analysis

Updated: Aug 16, 2017, 04:22 GMT+00:00

The British pound initially rallied against the Japanese yen, as Asian traders sold the yen overall. However, the 143-level offered enough resistance to

The British pound initially rallied against the Japanese yen, as Asian traders sold the yen overall. However, the 143-level offered enough resistance to turn things around and we felt to the 142 level, essentially wiping out all the gains from the session. The British pound itself got hammered around the Forex world, so it makes sense that the move happen. I think if we break down below the 141.75 level, it’s likely that we will continue to see the market reach down to the 141 level. I don’t have any interest in buying this market until we get some type of supportive daily candle, so I think that there is probably going to be a bit of a “fade the rallies” attitude to this market.

If we did break above the 143.25 level, the market would be free to go much higher, perhaps reaching towards the 144.50 level after that. I believe that extends to the 145 handle as well. However, we need some type of “risk on” type of situation and of course the British pound to pick up its feet around the world to see that happen. I believe there will be a significant amount of volatility as per usual, but ultimately this market certainly looks as if it is going to be soft. Having said that, pay attention to the young related pairs overall, because there is a bit of carry from other pairs such as USD/JPY, and NZD/JPY. Expect a lot of noise, but I think that the sellers have certainly made a significant statement during the day on Tuesday when it comes to the British pound in general. That being said, if the other young related pairs rise, this one might just simply lag behind them instead of melt down.

GBP/JPY Video 16.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement