Advertisement

Advertisement

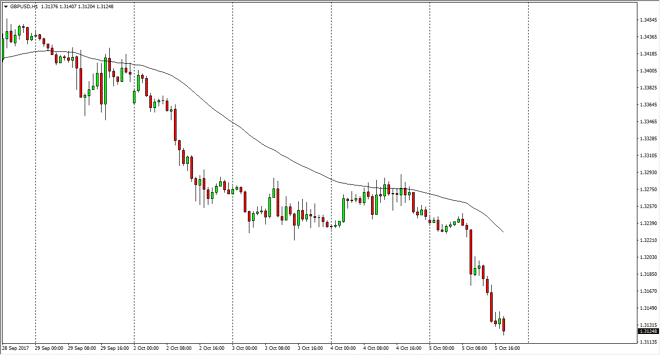

GBP/USD Forecast October 6, 2017, Technical Analysis

Updated: Oct 6, 2017, 06:03 GMT+00:00

The British pound initially went sideways on Thursday but then broke down rather significantly. We reached down towards the 1.31 handle, and breaking

The British pound initially went sideways on Thursday but then broke down rather significantly. We reached down towards the 1.31 handle, and breaking below the 1.32 level for me was a very negative sign. I think that the British pound will continue to sell off, perhaps reaching towards the 1.30 level underneath. The bearish pressure continues, and we are starting to see a reversal of what was once a very bullish market. The 1.30 level below is very important, and if we were to break down below there I think that the market comes undone.

The Federal Reserve looks likely to tighten monetary policy, but at the same time their questions as to whether or not the Bank of England will raise interest rates. It seems likely, but lately traders have become a bit spooked when it comes to owning the British pound. Ultimately, I think that we do find support underneath, especially near the 1.30 level, so it may be best to sit on the sidelines and wait for signs of stability. The last thing you want to do is to try and be the first buyer in a reversal, so if you are short-term trader, you may be able to sell the short-term rallies. Either way, I don’t think that this continues for much longer, and given enough time we will see a bit of a change. The British pound continues to be one of the more volatile currencies in the Forex world, as the trading world tries to figure out what’s going to happen with the British economy after the divorce from the European Union. With that significant amount of uncertainty, it’s going to continue to be a thorn in the side of British pound traders. Ultimately, the 1.3650 level is the longer-term prize.

GBP/USD Video 06.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement