Advertisement

Advertisement

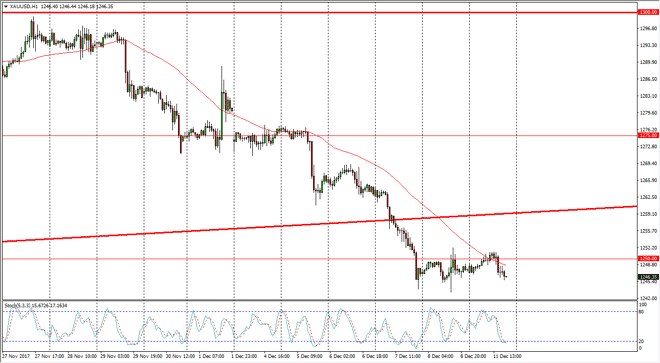

Gold Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:05 GMT+00:00

Gold markets are relatively quiet during the last couple of sessions, and that makes sense considering that we have the Federal Reserve releasing an interest rate statement on Wednesday.

Gold markets continue to be relatively quiet, as the $1250 level is essentially “fair value” from the longer-term consolidation between the $1200 level on the bottom, and the $1300 level above. This is a market that continues to react to geopolitical issues, and more importantly, the Federal Reserve. With the Federal Reserve releasing an interest rate statement on Wednesday, although most traders are expecting an interest rate high, the statement will be parsed as to whether it is hawkish or dovish, and that of course will have its effect on where the US dollar goes, which by extension has a massive effect on what happens with gold. If the statement is more hawkish than anticipated, that should continue to put bearish pressure on the gold markets, as it lifts the value of the US dollar. Alternately, if the central bank seems a bit more dovish than anticipated, that should send gold much higher.

There is also the possibility of some type of geopolitical issue, and that could send gold higher as well. In general, I believe that gold is going to continue to be soft in the meantime, what I like the idea of buying gold for the longer-term move. The market is more of an investment than anything else. Short-term trading of gold is going to be difficult, but this could change if the Federal Reserve changes its attitude. Looking at the hourly chart, we are in the oversold area, so I think we could get a short-term bounce back to the $1250 level, but that would just be a continuation of the short-term consolidation.

Gold Price Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement